- Nvidia slumps in after-hours trading as earnings don’t excite

- Equities mixed as attention turns to US data for direction

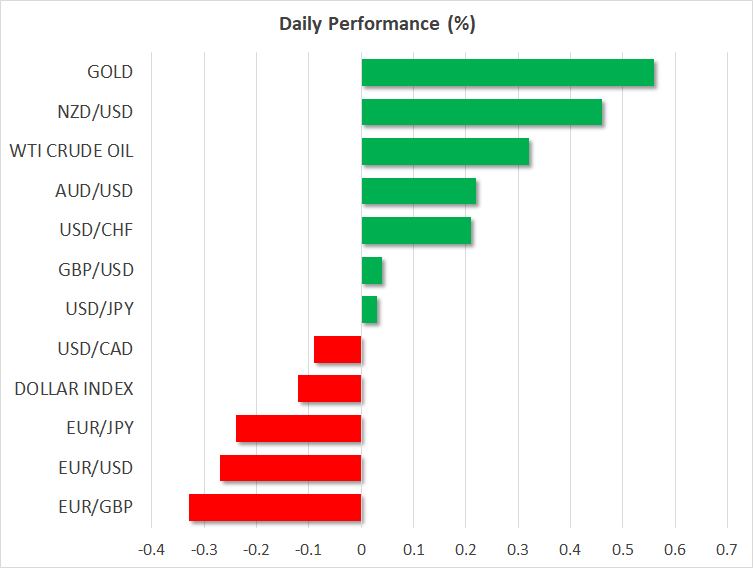

- Kiwi outperforms, euro slips on soft German and Spanish CPI figures

No post-Nvidia boost for equities

Nvidia’s much-anticipated earnings results for the second quarter failed to deliver on the very high expectations even as the chip giant saw its revenue more than double from a year ago.

Both revenue and earnings per share beat the consensus estimates and the company’s forecasts for the third quarter also topped expectations. However, some investors had set an even higher target and more importantly, the company’s senior executives were unable to dispel worries surrounding production issues for Nvidia’s next generation of AI chips.

With the stock having staged an incredible 150% year-to-date rally, it seems that investors were hoping to hear more details about how much revenue the company expects its new Blackwell chip to generate.

Equity markets had already been on edge after the other tech giants raised concerns about the scale of money being poured into investing in artificial intelligence and with Nvidia’s earnings not bringing any fresh excitement to the AI trade, the stock plunged by more than 8% in after-hours trading.

All eyes on next set of US releases

Wall Street closed lower ahead of Nvidia’s results as nerves got the better of tech stocks, which all slid. But futures are mixed today amid some signs of a rebound in European markets.

The recovery in equities from the July-August selloff has reached a critical juncture and neither Powell’s Jackson Hole speech nor Nvidia’s earnings were the catalyst that investors had hoped to take the gains to the next stage.

This week’s data releases may not provide much impetus to the bulls either and the spotlight is increasingly shining on next week’s jobs report out of the US to set the market’s direction.

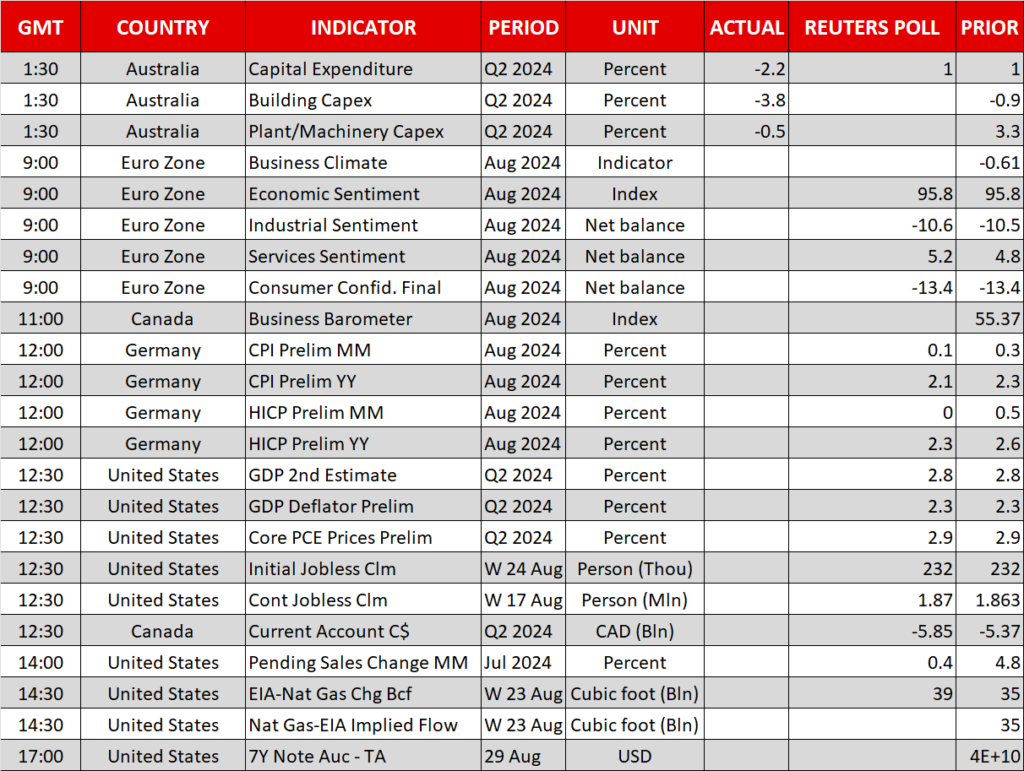

Nevertheless, amid still intense speculation about the pace of expected Fed rate cuts, today’s weekly jobless claims and revised estimates for Q2 GDP growth will be watched closely before attention switches to tomorrow’s PCE inflation and personal consumption numbers for July.

Euro hurt by soft CPI readings

The euro came under pressure on Thursday, dropping below $1.1100, following weaker-than-expected CPI readings from Eurozone countries reporting their numbers ahead of tomorrow’s flash estimates for the whole of the euro area.

Headline inflation in Spain fell more than expected to 2.4% in August and Germany’s national CPI prints, due at 12:00 GMT, also look set to come in below forecasts after regional data showed inflation fell in all German states.

The August data backs the latest rhetoric from ECB officials, which has been on the dovish side, paving the way not only for a 25-bps cut in September but also for steeper reductions for next year. The euro Kiwi gets a lift despite steadier greenback

In contrast, the New Zealand dollar surged today, coming just shy of the $0.63 level near eight-month highs after a big improvement in the ANZ business outlook survey. Some of the optimism seems to have spilled over to the Australian dollar, which is climbing even though capital expenditure unexpectedly shrunk in the second quarter, which does not bode well for next week’s GDP numbers.

As for the US dollar, it’s enjoying some positive momentum as the 10-year Treasury yield has steadied around 3.80%. Meanwhile, Atlanta Fed President Raphael Bostic suggested that he would like to see some more data to support a rate cut in September when he spoke late on Wednesday.

Source by: XM Global