- Eurozone inflation falls below ECB’s 2% target

- Underlying inflation gauges also decline

- Euro tests $1.11 as October rate cut looks almost certain

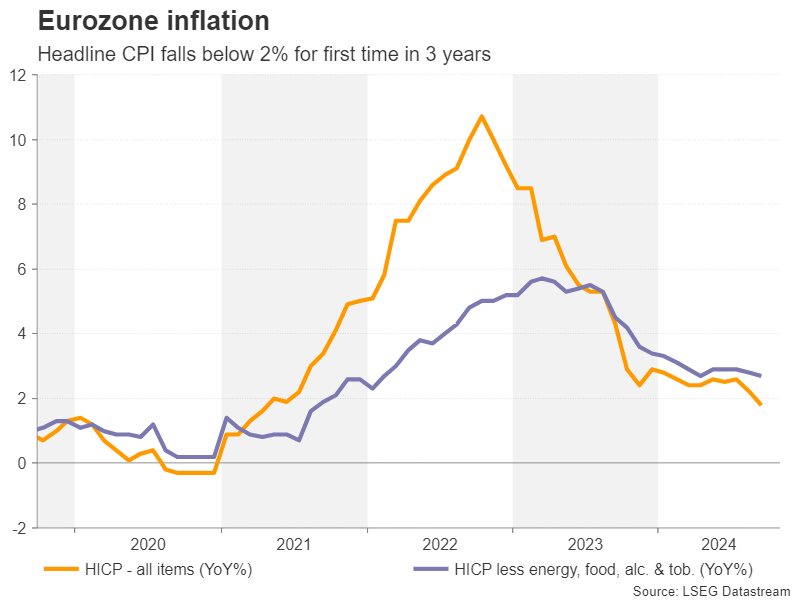

Inflation in the euro area has hit the lowest since June 2021, with the headline CPI rate dropping from 2.2% in August to 1.8% y/y in September. The two core measures of CPI that exclude volatile items eased marginally to 2.7% y/y.

The euro came under fresh selling pressure on the back of the data, but managed to find support at the $1.11 level as the flash readings were in line with expectations.

A 25-basis-point rate cut is now fully priced in for October, with investors betting on another 25-bps reduction in December that would take the accumulative rate cuts this year to 100 bps.

There’s been quite a significant turn of the tide over the past week when it comes to the ECB rate outlook. The flash September PMIs signalled the risks to Eurozone growth have tilted further to the downside rather than abate, while today’s preliminary CPI numbers have highlighted the real danger of the ECB undershooting its inflation target.

Yet, even as the Fed pushes back against aggressive rate cut bets, the euro is so far able to avoid a sharp slide against the US dollar.

Source by: XM Global