- AUDJPY trades lower again, below the 200-day SMA

- The bullish trend from the August 5 trough remains intact

- Momentum indicators are getting close to sending bearish signals

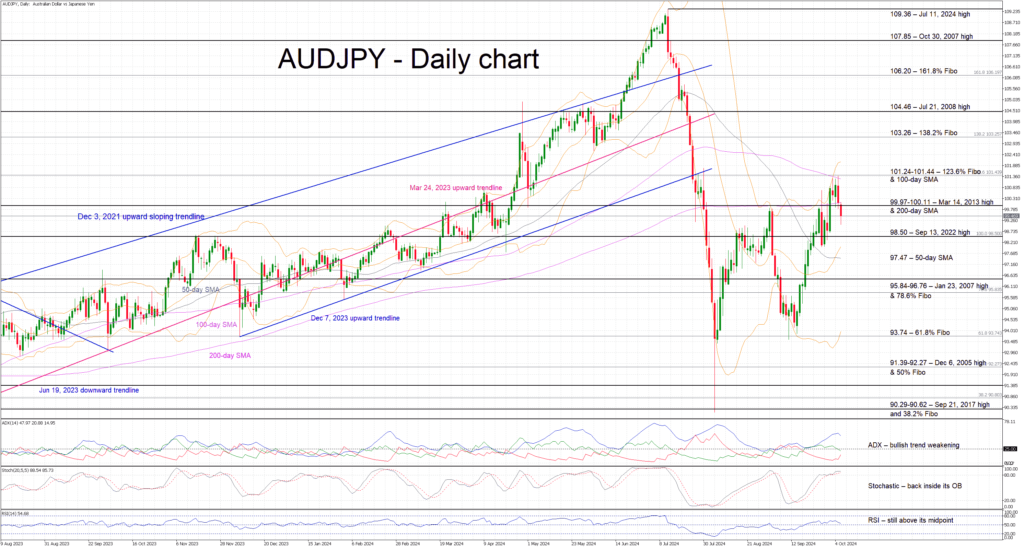

AUDJPY is recording its second consecutive red candle today, dropping again below the 200-day simple moving average (SMA). However, it managed to register a higher high first, and hence the bullish trend, which is in place since the August 5 low and is characterized by a series of higher highs and higher lows, remains valid. In fact, the aussie is weaker today across the board as the minutes’ publication surprised by showing that the board discussed scenarios for lowering and raising interest rates.

In the meantime, the momentum indicators are getting ready to turn bearish. In more detail, the Average Directional Movement Index (ADX) is edging lower thus pointing to a weakening bullish trend in AUDJPY. Similarly, the RSI is just a tad above its midpoint, revealing a weaker bullish pressure. Interestingly, the stochastic oscillator is comfortably hovering inside its overbought territory (OB). But it has failed up to now to mimic the AUDJPY’s price action and achieve a higher high, giving rise to a potential bearish divergence.

Should the bears remain in control, they could try to keep AUDJPY below the 99.97-100.11 region and target the September 13, 2022, high at 98.50. The door could then be open for the 95.84-96.76 area, which is populated by the January 23, 2007, high and the 78.6% Fibonacci retracement level of the September 13, 2022 – March 24, 2023 down leg, provided that the 50-day SMA at 97.47 is easily overcome.

On the other hand, should the bulls regain market control, they could try to lead AUDJPY back above the 99.97-100.11 area, which is defined by the March 14, 2013 high and the 200-day simple moving average (SMA). They could then stage a rally towards the 101.24-101.44 region and, if successful, be able to record a new higher high and gradually target the 103.26 level.

To sum up, AUDJPY is in the red today, but the bears need to break some key support levels for the current short-term bullish trend to be challenged.

Source by: XM Global