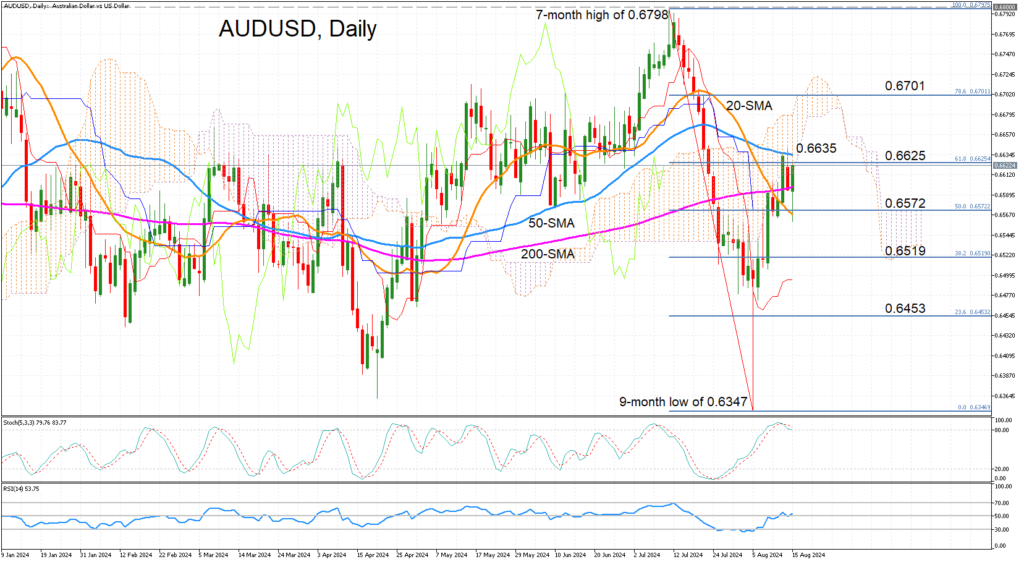

- AUDUSD retraces 61.8% of the July-August selloff

- But meets tough resistance at 50-day SMA

AUDUSD has surged by around 4.5% from the August 5 low of 0.6347 but the recovery has hit a snag at the 50-day simple moving average (SMA) in the 0.6635 region. After two days of unsuccessful attempts to overcome this barrier, the price has now slipped below the 61.8% Fibonacci retracement of the July-August slump at 0.6625.

The technical indicators remain positive but are sending mixed signals about the near-term price action. The stochastic oscillator is in the overbought region and trending lower, suggesting some losses could be on the cards. But the RSI is ticking up just above 50, signalling that the recovery has more to go.

If the bulls manage to clear the 50-day SMA, the next key hurdle is likely to be the 0.6700 level, which corresponds with the 78.6% Fibonacci. Surpassing this would turn the focus to July’s seven-month high of 0.6798 when it came just shy of the 0.6800 mark.

However, if the upswing runs out of steam, there’s likely to be some support at the 20-day SMA, which is slightly below the 50% Fibonacci of 0.6572. Slipping below this level could accelerate the declines towards the 38.2% Fibonacci of 0.6519.

All in all, AUDUSD’s rebound seems secure for now, but a climb above the 50-day SMA is needed to shift the short-to-medium-term outlook to bullish, while a drop below the 20-day SMA could switch the pair back to bearish mode.

Source by: XM Global