- AUDUSD is well in the red today

- Strong resistance set by the 200-day SMA

- Momentum indicators are mostly bearish

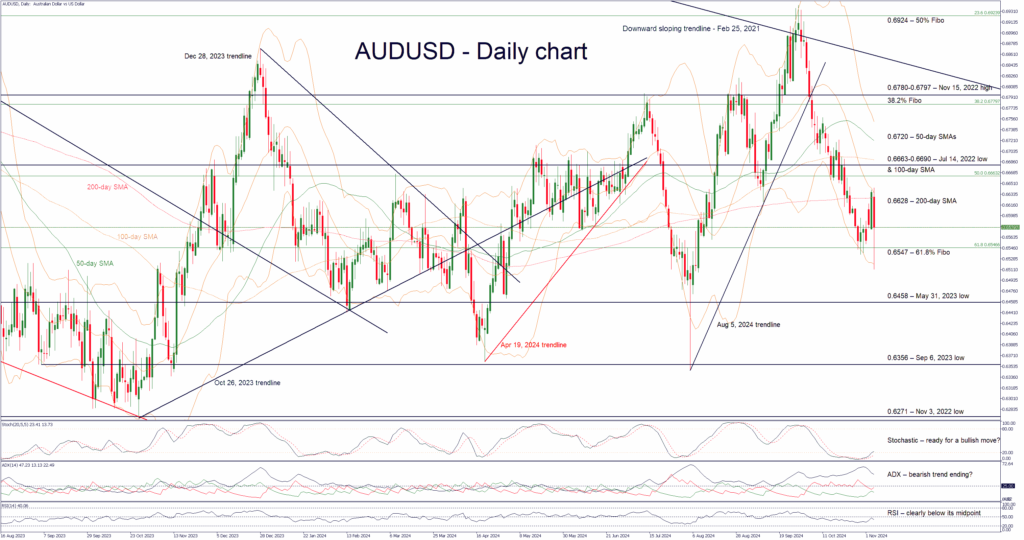

AUDUSD is trading lower today, reacting to the news that former president Trump has probably secured a second term in the White House, with today’s price action almost entirely canceling out Tuesday’s upleg, which was caused by the hawkish RBA meeting. The 200-day simple moving average (SMA) has acted as strong resistance, with the downtrend from the September 30 high remaining firmly in place. The market is gradually turning its focus to Thursday’s Fed meeting.

The momentum indicators are mostly bearish at this juncture. In more detail, the Average Directional Movement Index (ADX) is edging lower and thus signalling a weakening bearish trend in AUDUSD, while the RSI remains stuck below its 50-midpoint. Interestingly, today’s AUDUSD price action has probably put a pause in the stochastic oscillator’s effort to record a decisive break above its oversold territory (OS). Should this move higher resume, the bulls might finally get the chance to stage a small rally.

Should the bears remain hungry, they could try to break below the 61.8% Fibonacci retracement level of the October 13, 2022 – February 2, 2023 uptrend at 0.6547. The door could then be wide open for a more protracted move lower towards the March 31, 2023 low at 0.6458, with the next possible target being the September 6, 2023 low at 0.6536.

On the flip side, the bulls are aiming for a small upleg. They could firstly try to keep AUDUSD above 0.6547 and then gradually stage a move higher towards the 200-day SMA at 0.6628. If successful, they could then test the resistance set by the busier 0.6663-0.6690 area, which is defined by the July 14, 2022 low and the 100-day SMA.

To sum up, AUDUSD bears are taking advantage of Trump’s probable win, but they have failed again to push AUDSD decisively below the 0.6547 level.

Source by: XM Global