- EURJPY is hovering around the 159.64 level

- It is trading around 9% lower from its recent high

- Momentum indicators are mixed, and all eyes are on stochastics

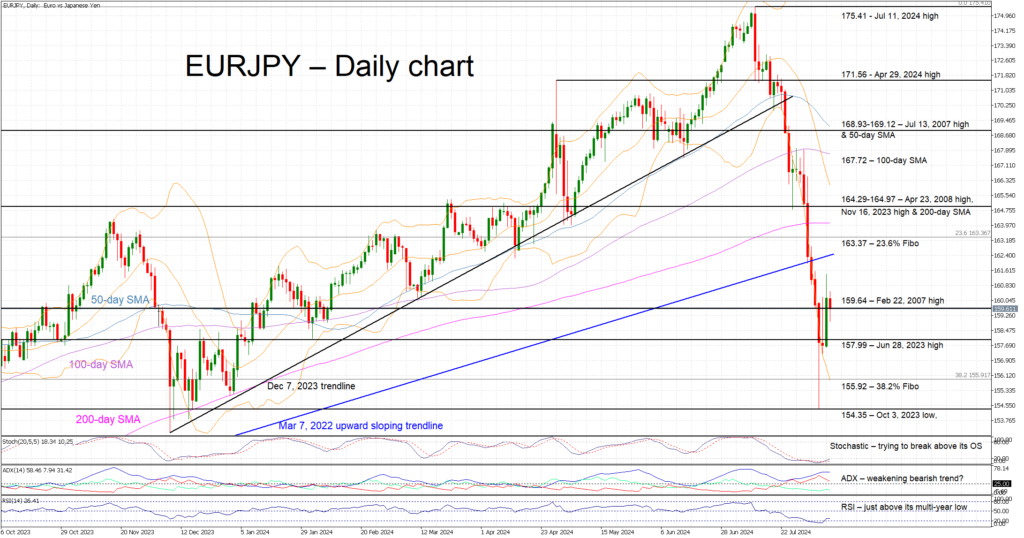

EURJPY is trading lower today, close to the 159.64 level and considerably above the August 5 low of 154.38. The market is clearly trying to find its footing following the recent rout that was triggered by the bigger-than-expected rate hike by the BoJ and fears about an imminent US recession. JPY was the primary beneficiary of this acute market reaction with EURJPY dropping around 9% from the all-time high of 175.41.

In the meantime, momentum indicators are mostly mixed. More specifically, the RSI is edging higher, but remains very close to its multi-year low. Similarly, the Average Directional Movement Index (ADX) is moving sideways, potentially signaling a weakening bearish trend in EURJPY. More importantly, the stochastic oscillator has surpassed its moving average, and it is preparing to cross above its oversold territory (OS). Should this move take place, it could be seen as a strong bullish signal.

Should the bulls remain confident, they would try to keep EURJPY above the February 22, 2007 high at 159.64 and then gradually stage a rally towards the 23.6% Fibonacci retracement level of March 7, 2022 – July 11, 2024 downtrend at 163.37. The next key resistance area could then come at the busy 164.29-164.97 region.

On the other hand, should the bears remain hungry, they would try to break below 159.64 and then push EURJPY towards the June 28, 2023 high at 157.99. If successful, they could then test the support set by the 38.2% Fibonacci retracement level at 155.92, a tad above the 2024 low of 154.38.

To sum up, the bulls are trying to recover part of their strong losses but EURJPY’s correction might still have legs.

Source by: XM Global