- EURCHF edges lower after weak euro area PMI surveys

- The prevailing downward trend is still firmly in place

- Momentum indicators tentatively acknowledge the recent rally

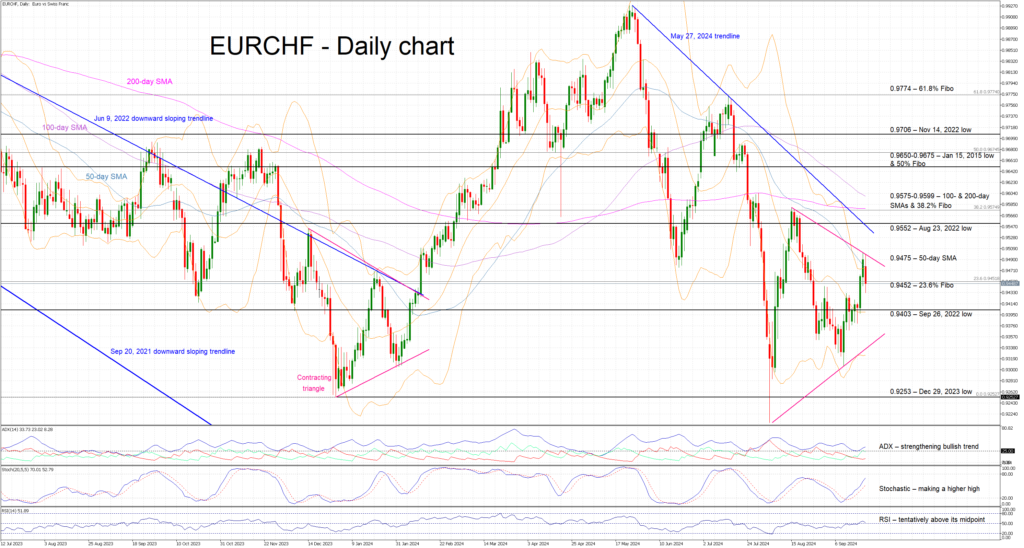

EURCHF is trading lower today after failing to overcome the resistance set by the 50-day simple moving average (SMA), and it is now threatening the recent rally. This bullish move that started the day before the recent ECB meeting might still have legs, and it could receive a significant boost by another SNB rate cut this week. However, the recent rally has not yet challenged the bearish trend that has been in place since the May 27, 2024 peak, and it is being supported by a series of lower highs.

In the meantime, the momentum indicators are tentatively bullish. In more detail, the RSI has climbed above its midpoint, confirming the recent bullish pressure. Similarly, the Average Directional Movement Index (ADX) is edging higher hence pointing to a muted bullish trend in EURCHF. More importantly, the stochastic oscillator has built a good gap from its moving average, and it is getting close to revisiting its overbought territory. However, the higher high in the stochastic could clash with the lower high recorded in EURCHF, and thus potentially open the door to a bearish divergence down the line.

Should the bulls remain confident, they will try to push EURCHF above both the 23.6% Fibonacci retracement of the January 13, 2023 – December 29, 2023 downtrend at 0.9451 and the 50-day SMA at 0.9475. They could then test the resistance set by the May 27, 2024 trendline and the August 23, 2022 low at 0.9552. If successful, they could then stage a rally towards the busy 0.9575-0.9599 area, which is populated by the 38.2% Fibonacci retracement and the 100- and 200-day SMAs.

On the flip side, the bears are trying to maintain their recent significant gains. They could try to keep EURCHF below the 0.9452 level and then push it towards the September 26, 2022 low at 0.9403. Even lower, the path looks unhindered until December 29, 2023, low at 0.9253.

To sum up, EURCHF bulls are trying to maintain the recent bullish momentum, but they probably need some extra help from this week’s SNB meeting.

Source by: XM Global