- EURCHF is in the green today, a tad below its 50-day SMA

- The prevailing downward trend is still firmly in place

- Momentum indicators are inconclusive at this stage

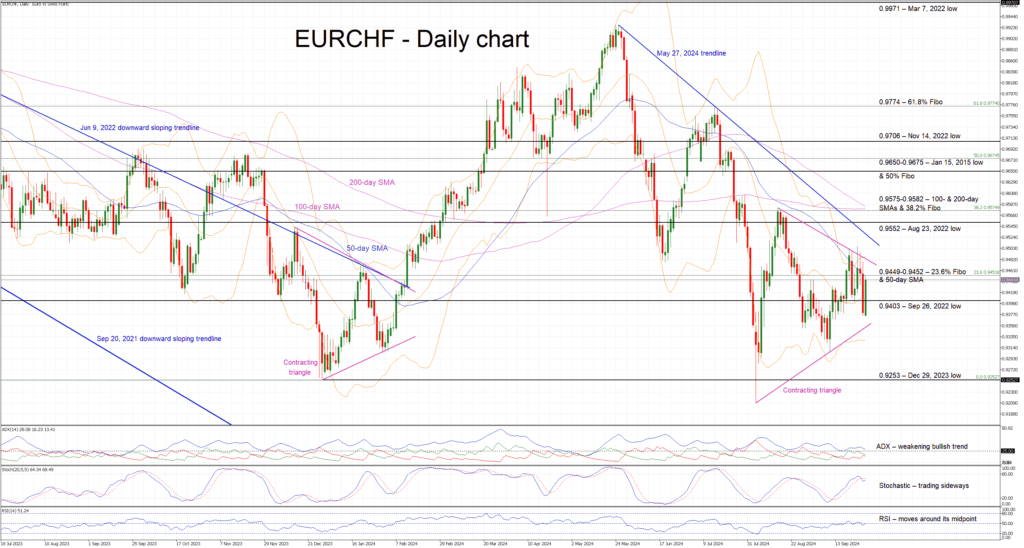

EURCHF is trading higher, above the September 26, 2022 low at 0.9403 but a tad below the 50-day simple moving average (SMA). The bearish trend from the May 27, 2024 peak remains in place and has yet to be challenged. However, a contracting triangle is developing, and it is characterized by a series of lower highs and higher lows, with EURCHF progressively trading into smaller ranges.

In the meantime, the momentum indicators are mixed. In more detail, the RSI continues to aimlessly hover around its midpoint, while the Average Directional Movement Index (ADX) is edging lower and potentially signaling the end of the recent bullish trend in EURCHF. More importantly, the stochastic oscillator has dropped below its moving average, but it appears unable to stage a strong downward move. Interestingly, a bearish divergence is present and could hence play a key role in the next leg in EURCHF.

Should the bulls remain confident, they will try to push EURCHF above the 0.9449-0.9452 area, which is populated by the 50-day SMA and the 23.6% Fibonacci retracement of the January 13, 2023 – December 29, 2023 downtrend. They could then test the resistance set by both the upper trendline of the contracting triangle and the May 27, 2024 trendline. If successful, the door could then open to a move towards the August 23, 2022 low at 0.9552 and, more importantly, the busy 0.9575-0.9582 area.

On the flip side, the bears are trying to maintain their sizeable gains. They could try to keep EURCHF below the 0.9449-0.9452 region and gradually push it towards the September 26, 2022 low at 0.9403. Even lower, the path looks obstacle-free until the December 29, 2023 low at 0.9253, provided that the triangle’s lower trendline is successfully broken.

To sum up, EURCHF bulls are trying to maintain the recent bullish momentum, but the next leg in EURCHF could occur in either direction.

Source by: XM Global