- EURGBP resumes downtrend, falls rapidly to 2½-year low

- Oversold signals detected, price trades at the bottom of a channel

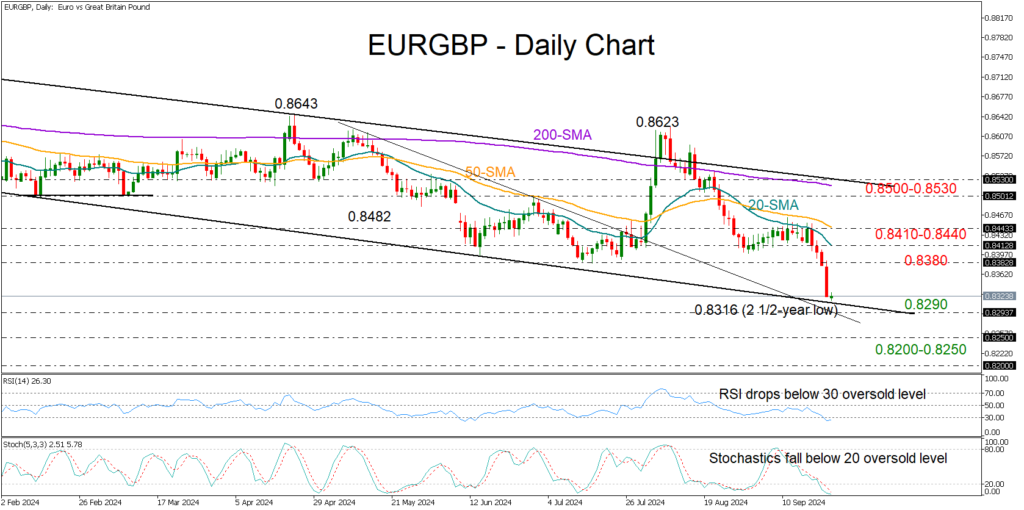

EURGBP plummeted to a 2½-year low of 0.8316 but held above the support line of the almost one-year-old bearish channel, fueling hopes that the bulls could still find a footing.

It is important to exercise caution as the RSI and stochastic oscillator have not yet found a bottom in the oversold zone, suggesting that downside pressures could persist for a bit longer before a potential upturn.

If sellers press the price below 0.8290-0.8300, they may face a critical test between the 0.8250 handle and the 2022 six-year low of 0.8200. Below the latter, there is no key obstacle till the 2016 resistance of 0.8115.

On the other hand, strong momentum is necessary for the bulls to overturn the current freefall and rise above July’s low of 0.8381. Closing above the 20-day simple moving average (SMA) at 0.8410 and the 50-day SMA at 0.8440 might be necessary as well to accelerate towards the 0.8500-0.8530 barrier.

Still, the short-term outlook can only turn bullish if there is a sustainable rally above the 200-day SMA and the long-term bearish channel.

Overall, although downside risks have not fully evaporated, EURGBP is trading near a significant support area, which suggests the possibility of bullish activity.

Source by: XM Global