- EURJPY attempts to rebound from 50.0% Fibonacci

- Faces rejection at 3-month high but remains positive

- Momentum oscillators remain cautiously titled to the upside

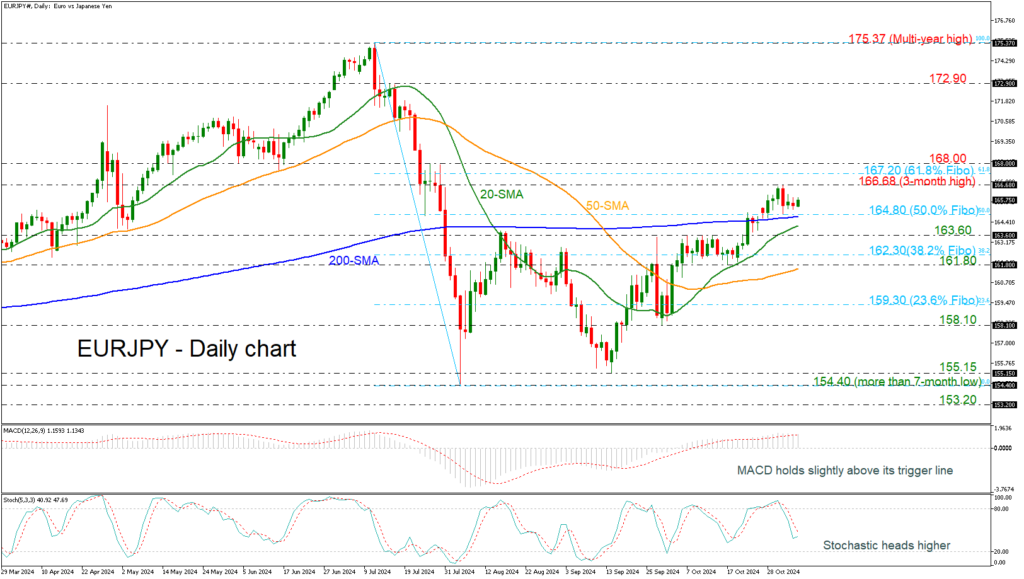

EURJPY is still standing above the 200-day simple moving average (SMA) and the 50.0% Fibonacci retracement level of the downward wave from 175.37 to 154.40 at 164.80. The market added more than 7% after the pullback from the 155.15 support level, creating a bullish tendency in the short term.

Technically, the MACD is moving above its trigger and zero lines, while the stochastic is turning higher above the 20 level. The SMAs are acting as a strong support level for the market.

A move to the upside could see immediate resistance at the three-month high of 166.68, but should the market increase positive momentum above this area, the 61.8% Fibonacci at 167.20 could be the next level in focus. A stronger barrier, though, could be found at the 168.00 round number since any strong violation of this point could increase chances for further gains, probably toward the 172.90 hurdle.

In the wake of negative pressures, the market could meet immediate support at the 50.0% Fibonacci of 164.80 and the 200-day SMA before it heads lower to the 20-day SMA at 164.20 and the inside swing highs of October 10 at 163.60. A successful close below this level could see a retest of the 38.2% Fibonacci of 162.30.

If the price remains above the 200-day SMA and rallies beyond the 61.8% Fibonacci of 167.20, there is hope that the market may enter a bullish phase in the medium term.

Source by: XM Global