- EURJPY lost 12% from multi-year high

- Short-term bias skewed to the upside, but caution needed

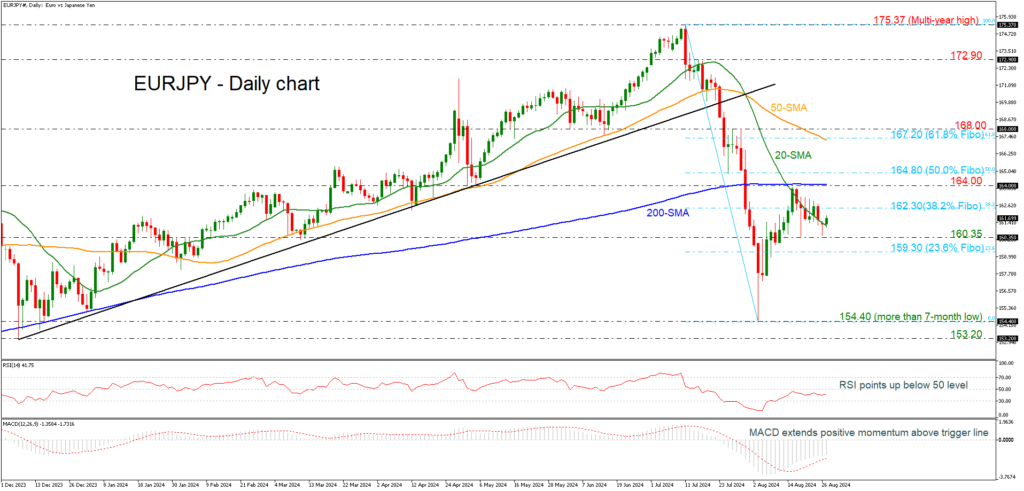

EURJPY remains under pressure, and risk is still on the downside as prices continue to drift lower after the failure attempt to climb beyond the 200-day simple moving average (SMA) at 164.00. In the bigger picture, EURJPY has lost around 12% from the multi-year high of 157.37 to the seven-month low of 154.40.

Prices rebounded off the 160.35 support level, but based on technical oscillators, momentum is still too weak to provide a sustained move higher. The RSI is sloping marginally up below the neutral threshold of 50, while the MACD is standing above its trigger line in negative territory.

Upside moves are likely to find immediate resistance at the 38.2% Fibonacci retracement level of the downward wave from 175.37 to 154.40 at 162.30. There is an important resistance zone between 164.00 and 164.80 (50.0% Fibonacci level). Rising above this area would help shift the focus to the upside towards the 50-day SMA, which overlaps with the 61.8% Fibonacci at 167.20.

To the downside, the latest bottom at 160.35 could be a key level for traders before hitting the 23.6% Fibonacci at 159.30. Steeper decreases could take the pair towards the more-than-seven-month low of 154.40.

In the short term, the bearish phase remains in play, especially if EURJPY continues to trade below the 200-day SMA and the 61.8% Fibonacci of 167.20. In the bigger picture, the market is bullish as long as the 200-week SMA holds.

Source by: XM Global