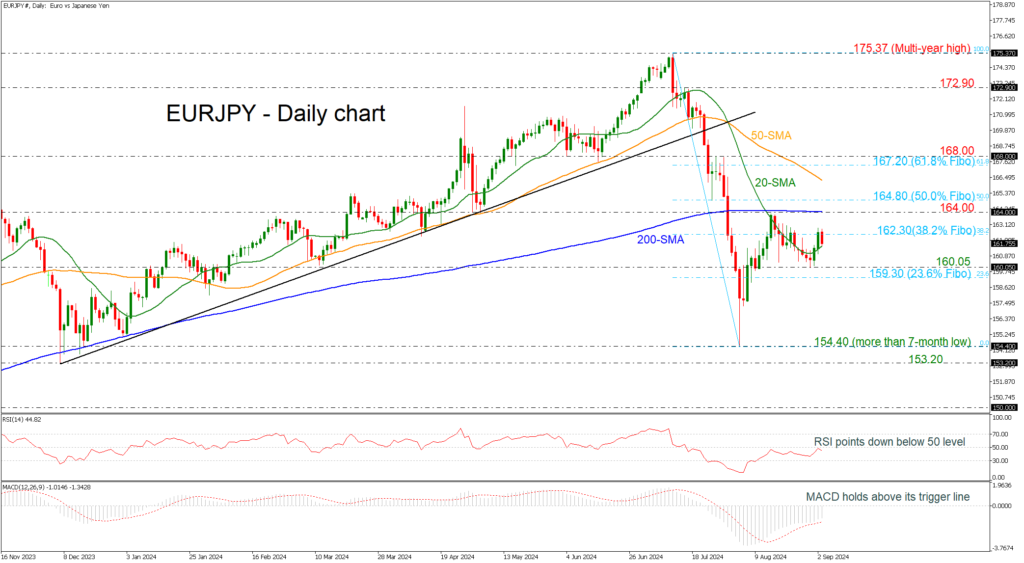

- EURJPY may find significant resistance at 164.00

- Rebound off a 7-month low still holds

- RSI heads down below 50 level

- MACD recovers above its trigger line

EURJPY is currently heading south following the unsuccessful battle with the 162.30 resistance level, which is the 38.2% Fibonacci retracement level of the down leg from 175.37 to 154.40. However, a more important struggle for the bulls could come at the 164.00 psychological level, which coincides with the 200-day simple moving average (SMA).

Technical oscillators show some mixed signs. The RSI is pointing downwards beneath the neutral threshold of 50, whereas the MACD is extending its positive momentum above its trigger line.

If the price has a closing session beyond the 162.30 barrier, then the fight with 164.00 would start. A break above it would open the way for a test of the 50.0% Fibonacci of 164.80 before meeting the 50-day SMA at 166.30.

In the negative scenario, a move lower could take the market towards the 159.30-160.05 support region, which encapsulates the 23.6% Fibonacci. More downside pressure could drive the bears towards the more-than-seven-month low of 154.40.

EURJPY has showed some improvement since the bearish spike on August 5 but there is lot of room to cover for changing the outlook to bullish.

Source by: XM Global