- EURJPY finds support near ascending line

- Stochastic and RSI look oversold; bullish move is expected

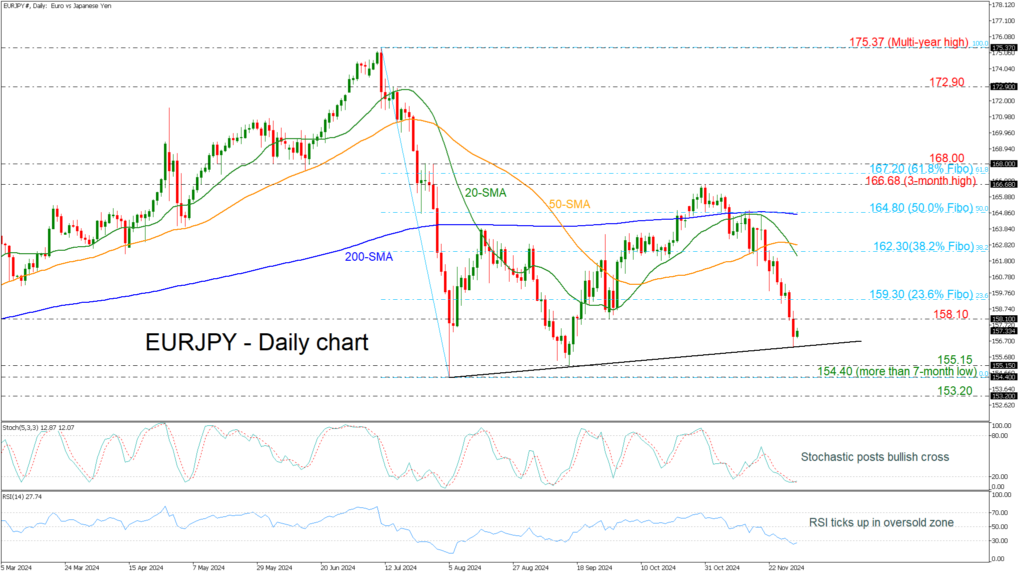

EURJPY has declined considerably after the pullback from the three-month high of 166.68, losing more than 6% in just one month. The pair recorded a fresh, more than two-month low of 156.36, with the simple moving averages (SMAs) confirming the bearish view in the short term.

However, the technical oscillators indicate the end of the dive. The stochastic oscillator posted a bullish crossover between its %K and %D lines in the oversold territory, while the RSI is pointing slightly up below the 30 level.

If prices continue to head lower, support could come from the 155.15 barrier ahead of the more-than-seven-month low of 154.40. A break below this area would reinforce the short-term bearish view and open the way toward the 153.20 barricade, registered in December 2023.

On the flip side, if the bulls retake control, price advances may stall initially near the 158.10 barrier and the 23.6% Fibonacci retracement level of the down leg from 175.37 to 154.40 at 159.30. A potential upside violation of the latest area would send traders toward the 38.2% Fibonacci of 162.30, which overlaps with the 20-day SMA.

In summary, the EURJPY remains above the medium-term uptrend line, showing indications of a potential bullish wave once more.