- EURJPY still consolidating but immediate bias is bullish

- Major resistance area lies ahead

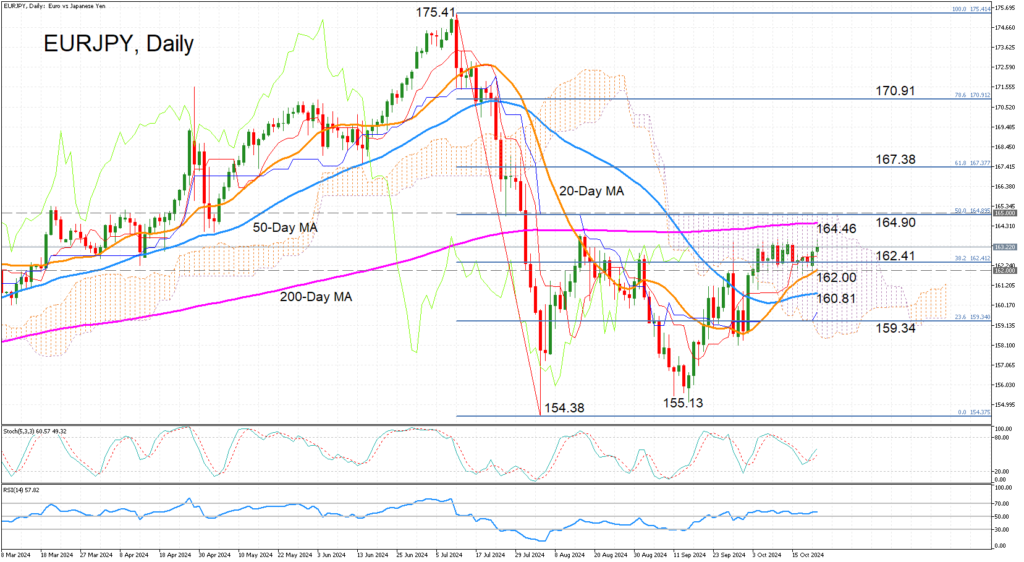

EURJPY has been trading within a narrow sideways range since early October, but the immediate bias has turned positive over the last couple of sessions. The stochastic oscillator is trending upwards, while the RSI is slightly above its 50-neutral level.

The price reached a two-month intra-day peak of 163.65 earlier on Tuesday before pulling back, reflecting a very weak upside momentum. But even if the bulls manage to stay in control and plough ahead, getting past the 164.45-165.00 region will be very difficult.

The 200-day simple moving average (SMA) is blocking the way at 164.46, while the 50% Fibonacci retracement of the July-August down leg stands at 164.90. Furthermore, the top of the Ichimoku cloud overlaps with the 50% Fibonacci, underscoring the significance of this resistance region.

Nonetheless, a successful breakout above 165.00 would shift the medium-term picture from neutral to bullish and clear the way towards the 61.8% Fibonacci of 167.38.

If, though, the bulls fail to make much progress and the positive momentum fades, there’s likely to be strong support around the 20-day SMA just above the 162.00 mark. Slipping below this level would bring the 50-day SMA under the spotlight at 160.81 before sellers turn their attention to the 23.6% Fibonacci of 159.34.

A drop beneath the 23.6% Fibonacci would also take the price below the Ichimoku cloud, risking a return to the bearish phase.

In brief, EURJPY still has a chance of resuming its rebound from the September low, but reclaiming the crucial 165.00 handle will not be easy.

Source by: XM Global