- EURUSD maintains sideways move as 1.0940 barrier blocks the way up

- Technical risk is on the positive side; eyes on 1.0970 too

- US PPI due at 12:30 GMT; FOMC member Bostic speaks today

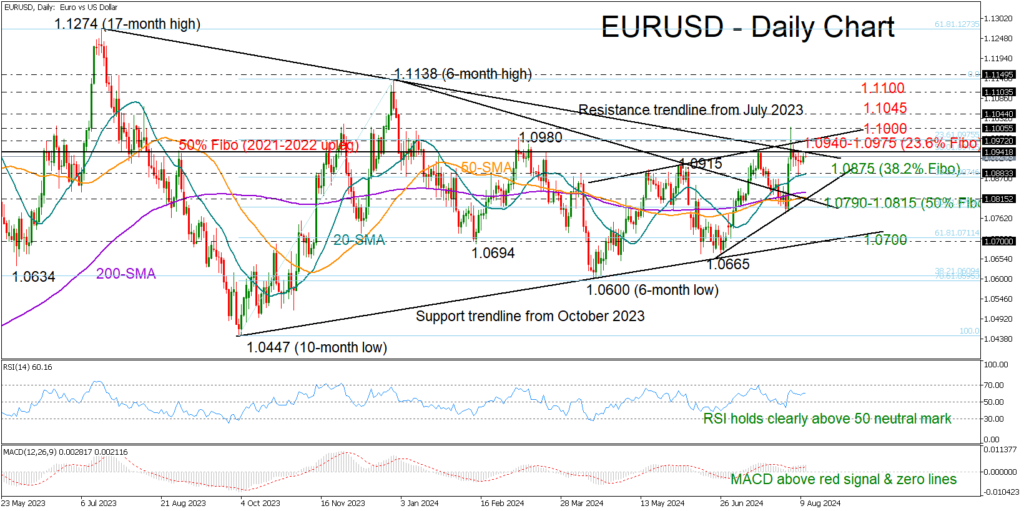

EURUSD continues to face restrictions near the 1.0940 level and the resistance trendline from July 2023, which squeezed the price below a seven-month low of 1.1007 last week.

The RSI has yet to reach overbought levels, remaining elevated within the bullish area. Similarly, the MACD is staying comfortably above its red signal line, implying that the bulls might continue to defend the bounce off the 20-day SMA.

A decisive close above the 1.0940-1.0970 area could provide direct access to the 1.1000 psychological mark, while an extension above the 1.1045 barrier could open the door for the 1.1100 round level. The 1.1150 region could be the next destination if upside forces persist.

On the downside, the 20-day SMA coupled with the 38.2% Fibonacci retracement of the October-December upleg may hinder selling pressure near 1.0875, preventing a drop into 1.0790-1.0815. Should the bears breach the latter, the decline could pick up steam towards the 1.0700 mark.

All in all, EURUSD might have some extra bullish fuel in the tank. Whether this will be sufficient to surpass the strong resistance range of 1.0940-1.0970 remains to be seen.

Source by: XM Global