- EURUSD extends rally, hits 1.1130

- But oscillators point to fading momentum

- A setback may be possible before the next leg north

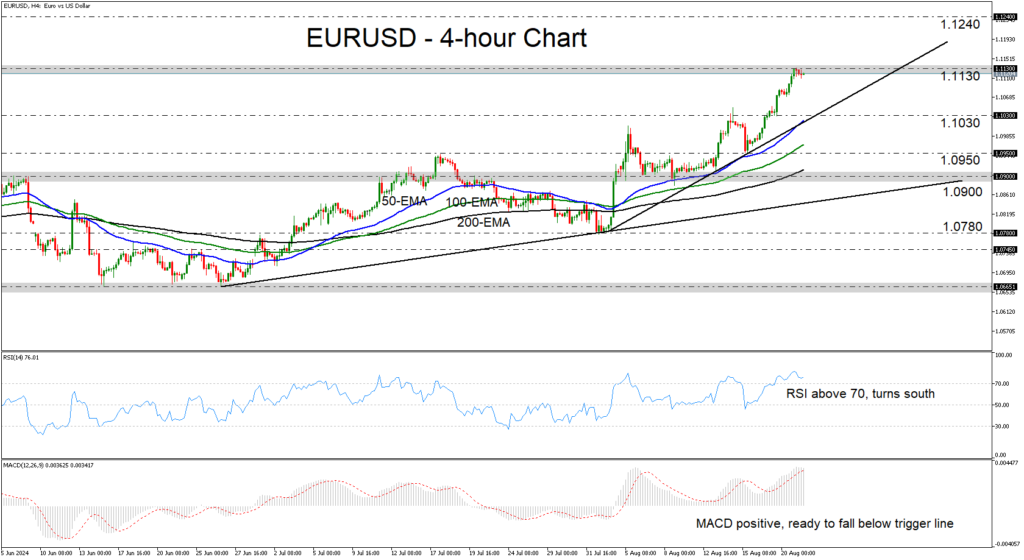

EURUSD has been in a steady rally since August 15, when it hit support at 1.0950, and it is currently testing the key resistance zone of 1.1130, a zone that stopped the bulls from heading further north back in December, as well as back in July 2023. Overall, the pair is trading above a short-term uptrend line drawn from the low of August 2, and well above the upper bound of a prior sideways range, at around 1.0900.

Although the technical picture on the 4-hour chart appears to be overly bullish, the short-term oscillators are suggesting that the upside momentum is fading, which means that a corrective setback may be in the works before the next leg north. The RSI has peaked within its above-70 zone, while the MACD, although extremely positive, has turned south as well and looks ready to fall below its trigger line.

A retreat may invite buyers from near the aforementioned uptrend line and the 1.1030. If this is the case, another bullish wave could surpass the 1.1130 high and aim for the 1.1240 area, marked by the high of March 1, 2022.

On the downside, a dip below 1.1030 could trigger a larger correction, as it would also take the pair below the short-term uptrend line. The bears may feel confident in targeting the low of August 15, at 1.0950, or the upper bound of the sideways range that contained most of the price action since the beginning of the year. That bound stands at 1.0900.

To recap, EURUSD remains in a steep short-term uptrend, but the short-term oscillators suggest that a corrective slide may be on the cards before the next impulsive wave.

Source by: XM Global