- EURUSD remains under selling pressure

- Next pause at 1.0665-1.0685

- Stochastics and MACD confirm bearish structure

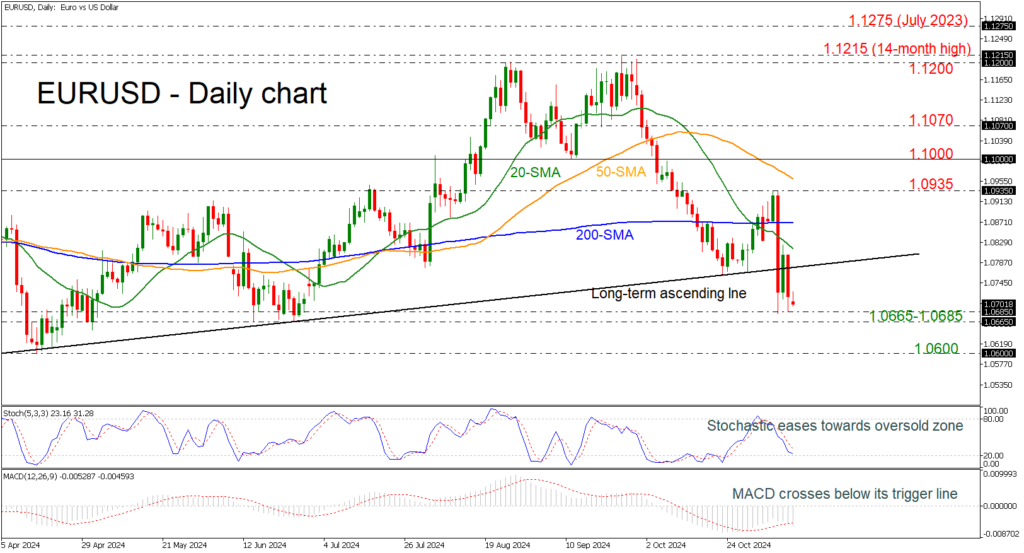

EURUSD recently took a considerable dive, falling beneath the 1.0700 round number and developing below the long-term ascending trend line. The pair began the day with a negative gap, with the technical oscillator suggesting further declines. The stochastic is moving toward the oversold region, while the MACD is extending its bearish momentum beneath its trigger and zero lines.

If the market retreats further, it could test the restrictive supportive region of 1.0665-1.0685 before resting near the 1.0600 handle, creating a lower low.

On the flip side, a successful attempt above the ascending trend line could find significant obstacles at the 20- and 200-day simple moving averages (SMAs) at 1.0815 and 1.0870, respectively. Further up, the peak at 1.0935 could potentially halt the upward trend.

Overall, EURUSD has been shifting from a broader bullish outlook to a bearish one, particularly after the drop below the uptrend line.

Source by: XM Global