- EURUSD retraces lower after hitting 4-month high

- The bears eye converging 50- and 200-day SMAs

- Oscillators deteriorate but remain in positive zones

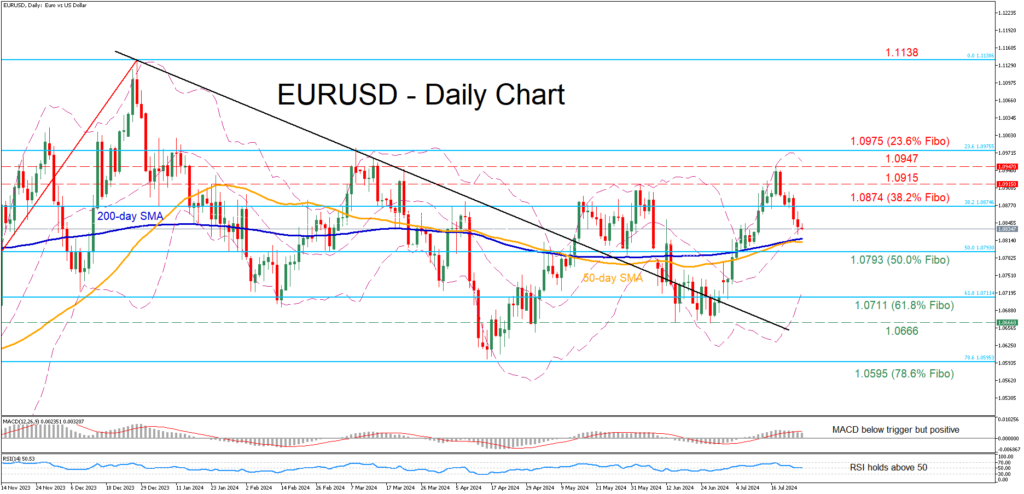

EURUSD had been rising steadily following its bullish breakout from a downward sloping trendline in early July, posting a fresh four-month peak of 1.0947 last week. However, the pair has been experiencing a correction since then, with the price approaching the converging 50- and 200-day simple moving averages (SMAs).

Should the retreat extend further and the pair break below its SMAs, initial support could be found at 1.0793, which is the 50.0% Fibonacci retracement of the 1.0447-1.1138 upleg. Lower, the 61.8% Fibo of 1.0711 might act as the next line of defense. Failing to halt there, the pair may then decline towards the June bottom of 1.0666.

Alternatively, if the price reverses back higher, the 38.2% Fibo of 1.0874 could prevent initial upside attempts. A violation of that hurdle could pave the way for the June peak of 1.0915 ahead of the recent four-month high of 1.0947. Claiming the latter barricade, the bulls could attack the 23.6% Fibo of 1.0975.

In brief, EURUSD has come under selling pressure after posting a fresh four-month high last week. Should the pullback extend further, the pair’s next crucial battle will probably take place around the converging 50- and 200-day SMAs.

Source by: XM Global