- EURUSD holds above 20-day SMA but bias turns neutral

- Bulls still have a chance as field of support levels lies beneath

- But double-top formation hard to ignore

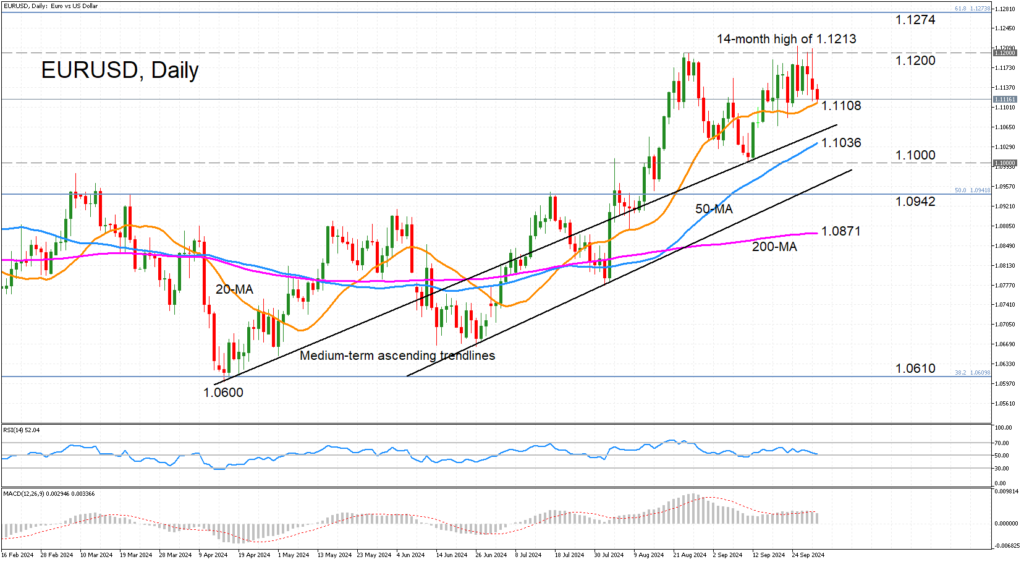

EURUSD has retreated from last week’s 14-month high of 1.1213, erasing the short-term bullish bias. But the pair is so far managing to hold above the 20-day simple moving average (SMA) around 1.1108.

The momentum indicators underscore the neutral picture in the near term as the RSI appears to be flatlining just above the 50 level, while the MACD has slipped just below its red signal line but remains comfortably in positive territory.

The 20-day SMA is the nearest support barrier but a dip below it would switch the focus to the downside, and more specifically, to the upper ascending trendline. Slightly lower is the 50-day SMA at 1.1036. If these barriers fail, they would expose the 1.1000 level, which is the lower low from September – conceived between the double tops around 1.1200.

A drop below 1.1000 would confirm the double-top pattern, which is a bearish signal, as well as undermine the bullish medium-term structure. However, the positive outlook is likely to stay intact as long as the price doesn’t breach the 200-day SMA at 1.0871, while ahead of that, the lower ascending trendline and the 50% Fibonacci retracement of the January 2021-September 2022 downleg at 1.0942 might come to the bulls’ defence.

In the event that the price successfully rebounds off the 20-day SMA, the 1.1200 zone is likely to be tested again before aiming for the 61.8% Fibonacci of 1.1274, after which, attention would turn to the 1.1300 level.

All in all, EURUSD still has a chance of resuming its medium-term uptrend, but the formation of a double-top pattern could scupper those prospects.

Source by: XM Global