- GBPJPY gains ground after upbeat UK CPI data

- Technical signals endorse bullish efforts

- Buyers need confirmation above 197.35

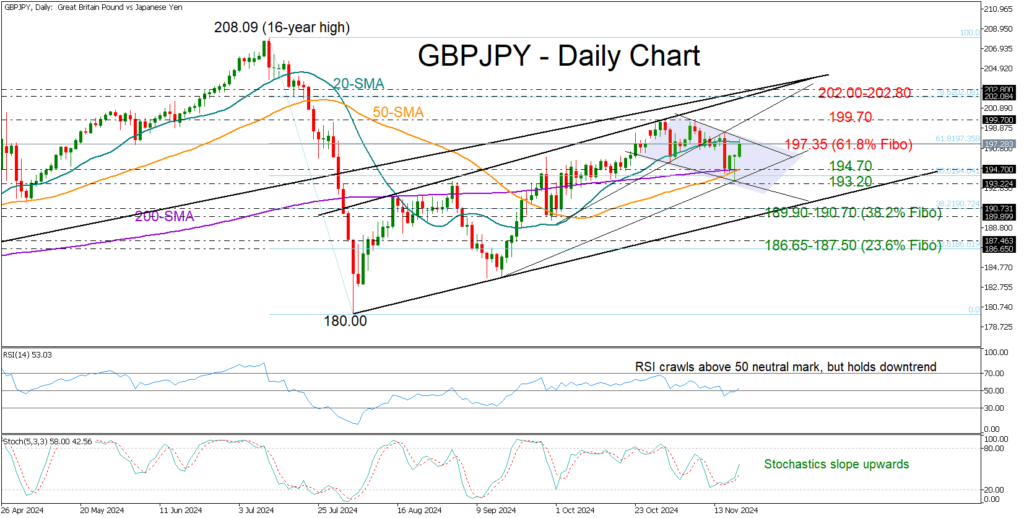

GBPJPY advanced to an intra-day high of 197.77 after hotter-than-expected UK CPI inflation data gave traders confidence that the Bank of England might hold interest rates steady in December.

Earlier, the pair had built a solid base around 194.70, supported by its 50- and 200-day simple moving averages. This suggests the upward pattern that started in August is still in play, despite November’s bearish tendencies.

Looking at the technical indicators, the RSI and stochastic oscillator are endorsing the current euphoria in the market, but downside risks could remain in play if the price fails to close above the nearby resistance of 197.35, where the 20-day SMA and the 61.8% Fibonacci retracement level of the July-August downtrend are positioned. If the bulls can push past that border, they could next target October’s bar of 199.70, and beyond that, the 202.00-202.80 range.

On the flip side, if the price steps below the 194.70 floor, the tentative falling line from October could halt selling forces near 193.20. If not, the decline could stretch toward the 38.2% Fibonacci mark of 190.70, and potentially reach the August support line at 189.90. Additional losses from there would violate the short-term uptrend, prompting a new decline toward the 186.65-187.50 zone.

Overall, GBPJPY looks like it’s setting up a potential new bullish move, but traders will likely wait for a confirmation above 197.35 before jumping in.