- GBPJPY pulls back from its 16-year peak of 208.10

- The pair falls to its lowest level since May 16

- RSI and MACD warn of an overstretched retreat

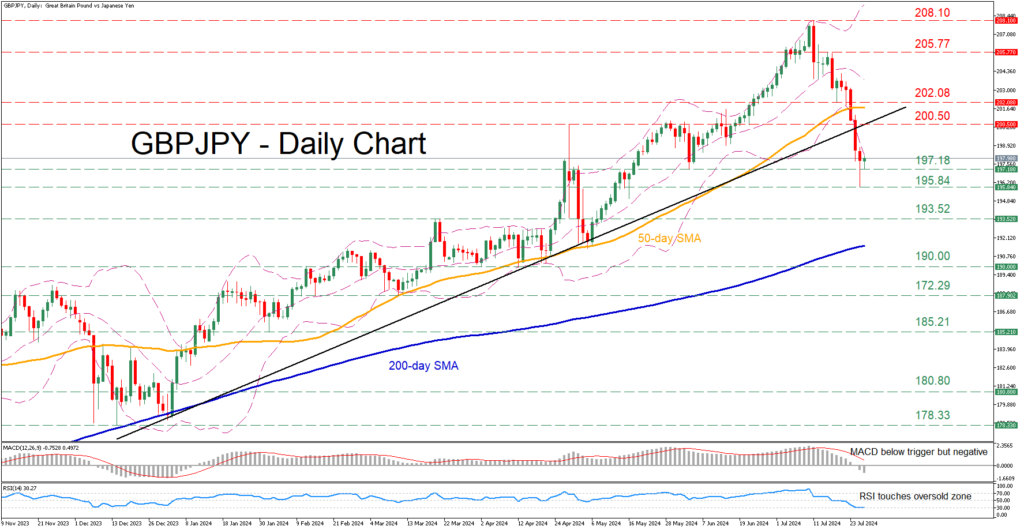

GBPJPY has been in a prolonged uptrend since early 2024, posting a 16-year high of 208.10 on July 11. However, the pair has been undergoing a pullback since then, with the price violating both the supportive trendline in place since January and the 50-day simple moving average (SMA).

Should the bears attempt to push the price lower, they would have to initially clear the June low of 197.18 before attention shifts to the recent two-month bottom of 195.84. Failing to halt there, the pair might challenge the March resistance of 193.52. Further declines could then cease at the 190.00 psychological mark, which provided strong support in April.

Alternatively, if the price edges back higher, the April peak of 200.50 may prove to be the first barrier for the bulls to overcome. Piercing through that wall, the price could advance towards 202.08 before it faces the July resistance of 205.77. A violation of the latter might set the stage for the 16-year high of 208.10.

In brief, GBPJPY has been experiencing a downside correction from its recent multi-year high, with the break below the crucial ascending trendline further darkening the technical picture. However, the bears should be cautious as the short-term oscillators are flagging overbought conditions.

Source by: XM Global