- GBPUSD advances after its bounce off 200-day SMA

- A potential breach of 50-day SMA could improve outlook

- Oscillators suggest strengthening positive momentum

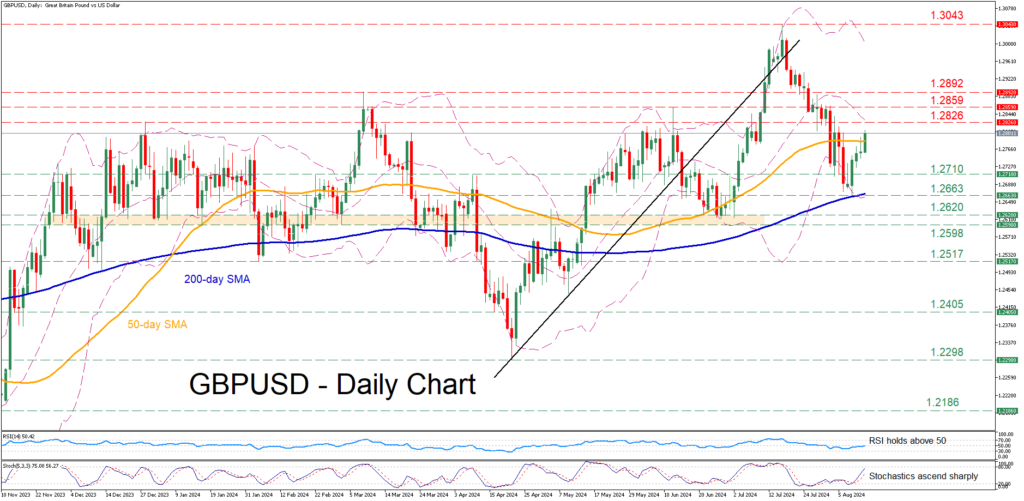

GBPUSD had been on the rise following its deflection at the 200-day simple moving average (SMA) on August 8. After four consecutive daily green candlesticks, the pair is on track to reclaim its 50-day SMA as the momentum indicators are hinting at an improving positive bias.

If the price extends its recent rebound, immediate resistance might be found at the December 2023 high of 1.2826. Higher, the June peak of 1.2859 may prove to be the next barricade for the bulls to clear. A break above that zone could open the door for the March high of 1.2892.

On the flipside, initial declines could pause at 1.2710, a region that provided resistance multiple times in the recent past but could now serve as support. Slicing through that wall, the pair may challenge the August low of 1.2663, which overlaps with the 200-day SMA. Failing to halt there, the pair might descend towards the 1.2620-1.2598 range, which is framed by the June and March lows.

Overall, GBPUSD has been gaining ground in the past few sessions after finding its feet at the crucial 200-day SMA. However, a failure to claim the 50-day SMA, which is currently under scrutiny, could lead to the pair reversing back lower.

Source by: XM Global