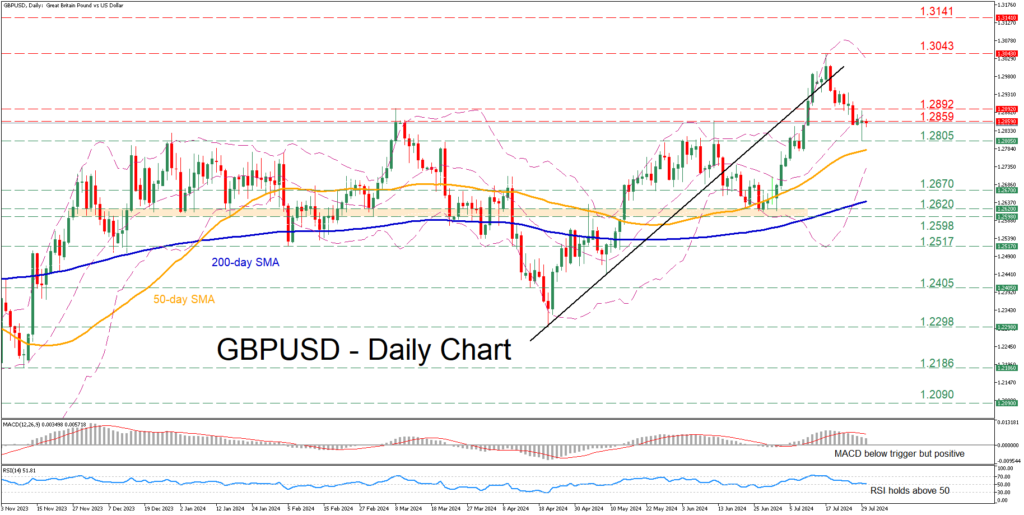

- GBPUSD declines steadily from 1-year high

- The bears eye the 50-day SMA as next target

- Momentum indicators ease but remain positively tilted

GBPUSD had been on the rise following its bounce off the 50-day simple moving average (SMA) in late June. Although the pair posted a fresh one-year high of 1.3043 on July 17, it has been undergoing a downside correction since then.

Should bearish pressures persist, the price could face the recent support of 1.2805, a region that also acted as resistance in March, May and June. Lower, the May-June support of 1.2670 may prevent further declines. Failing to halt there, the pair might descend to challenge the 1.2620-1.2598 range, which is framed by the June and March lows.

On the flipside, if the pullback fades and the pair reverses back higher, the June high of 1.2859 may prove to be the first barricade for the bulls to clear. A break above that zone could open the door for the March peak of 1.2892. Should that hurdle also fail, attention could shift to the one-year peak of 1.3043.

Overall, GBPUSD has come under selling pressure after its trip to a fresh one-year high came to an end. For the short-term technical picture to deteriorate further, the pair needs to slide beneath the 50-day SMA.

Source by: XM Global