- GBPUSD remains in negative area

- But holds beyond the downtrend line

- RSI and MACD give some optimistic views

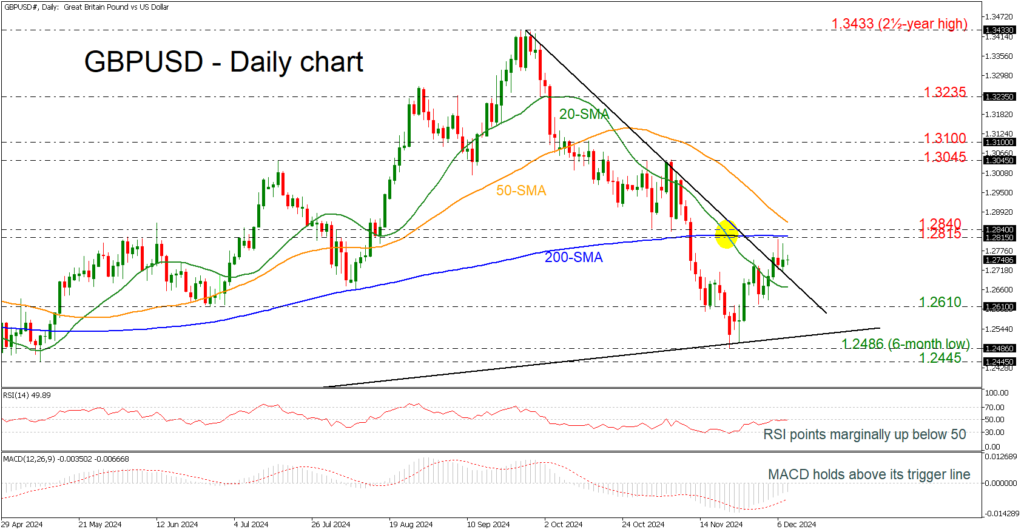

GBPUSD is experiencing a new bullish attempt to remain above the short-term descending trend line, but the 200-day simple moving average (SMA) at 1.2815 appears to be a tough obstacle for traders.

If the market overcomes the aforementioned barrier, then immediate resistance would come from the inside swing lows at 1.2840. Should the price move above the 50-day SMA at 1.2870, it could spark optimism among the bulls. The 1.3045 and the 1.3100 resistance levels may endorse the bullish retracement in the short-term view.

On the other hand, a drop below the downtrend line again would endorse the negative structure, testing the 20-day SMA at 1.2670 before meeting the previous low near 1.2610.

The technical oscillators show some optimism for further increases. The RSI is battling with the neutral threshold of 50, while the MACD remains well above its trigger line below the zero level.

All in all, GBPUSD is still in bearish territory, especially after the failed attempt to surpass the 200-day SMA.