- GBPUSD in bullish correction in short-term

- RSI and MACD head north

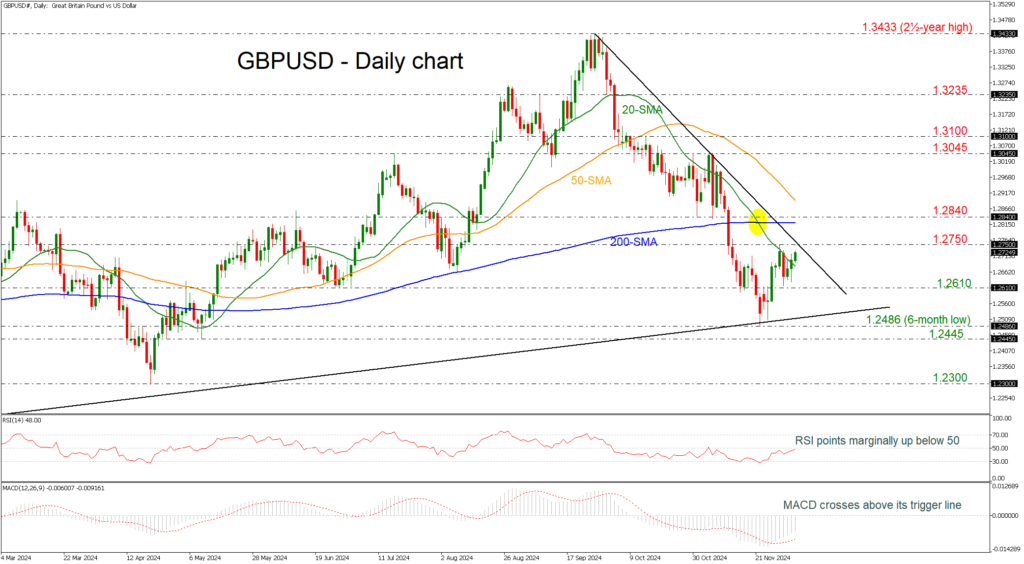

GBPUSD has been in a rising correction mode over the last couple of weeks after the bounce off the six-month low of 1.2486. The pair may revisit the 1.2750 barrier, which is holding near the short-term downtrend line. If the market successfully breaks this area, it may face a significant challenge at the flat 200-day simple moving average (SMA) at 1.2820, before encountering the 1.2840 resistance and the 50-day SMA around 1.2900.

However, if the price retreats below the 1.2610 support, then it may challenge the long-term ascending trend line at 1.2530 and the six-month bottom of 1.2486. Slightly lower, the 1.2445 support may pause the decline but the 1.2300 round number may be the next key turning point in the market.

According to technical oscillators, the RSI is ready to cross above the 50 level, and the MACD is strengthening its positive momentum above its trigger line. Both are indicating further increases in the market.

Overall, GBPUSD has shown a bullish tendency over the last one-and-a-half-year and any climbs beyond the 200-day SMA would also shift the short-term negative bias to a positive one.