- GBPUSD prints new high near 1.3300 after FOMC rate decision

- Technical signals remain bullish but clear close above 1.3200 is needed

- BoE expected to leave rates steady at 11:00 GMT

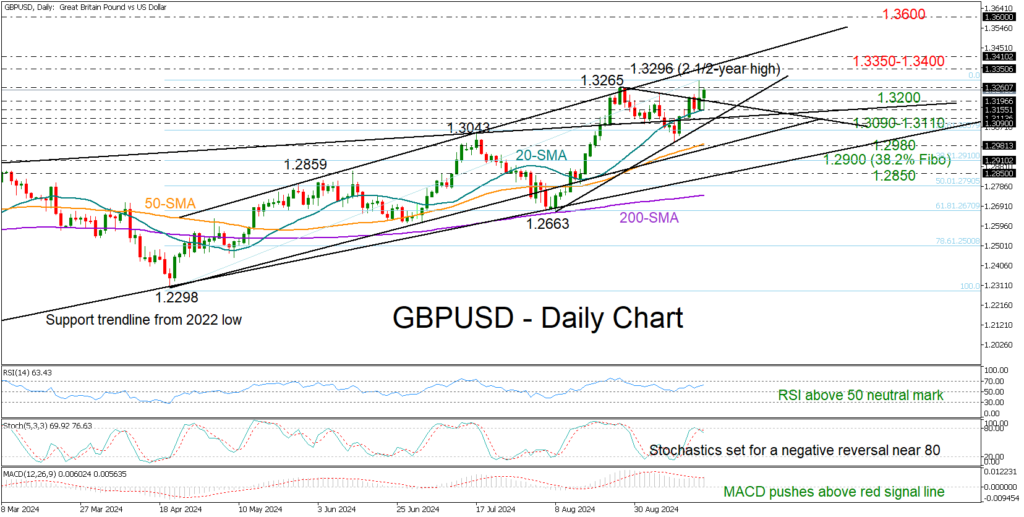

GBPUSD remains committed to closing above the 1.3200 level for one more day. The Fed delivered a surprise double rate cut of 50bps on Wednesday, lifting the pair to a new 2 ½-year high of 1.3296. Powell expressed confidence in avoiding a downturn but gave no clear indication of the pace of the easing cycle, causing the price to drop below 1.3200 again.

The BoE’s rate decision is the next highlight on the calendar, and the pair is currently flirting with the August bar of 1.3265. With the RSI consistently rising above 50 and the MACD about to cross its red signal line in the positive region, the risk is skewed to the upside. Yet, with the stochastic oscillator preparing for a downturn, room for improvement might be limited.

Above 1.3265, the price could get congested around the resistance line from May currently seen at 1.3350. The 1.3400 psychological mark could also challenge the bulls. If not, the pair could rocket up to 1.3600 last seen in February 2022.

On the downside, there are a couple of support levels to keep in mind. The 20-day SMA at 1.3155 and the trendline zone of 1.3090-1.3110 will be closely watched if the price pulls back below 1.3200. Even lower, the spotlight might shift to the 50-day SMA and the ascending line at 1.2980. Another violation there could take a rest near 1.2900.

Overall, for GBPUSD to sustain its pattern of higher highs and higher lows, it must stay buoyant above 1.3200.

Source by: XM Global