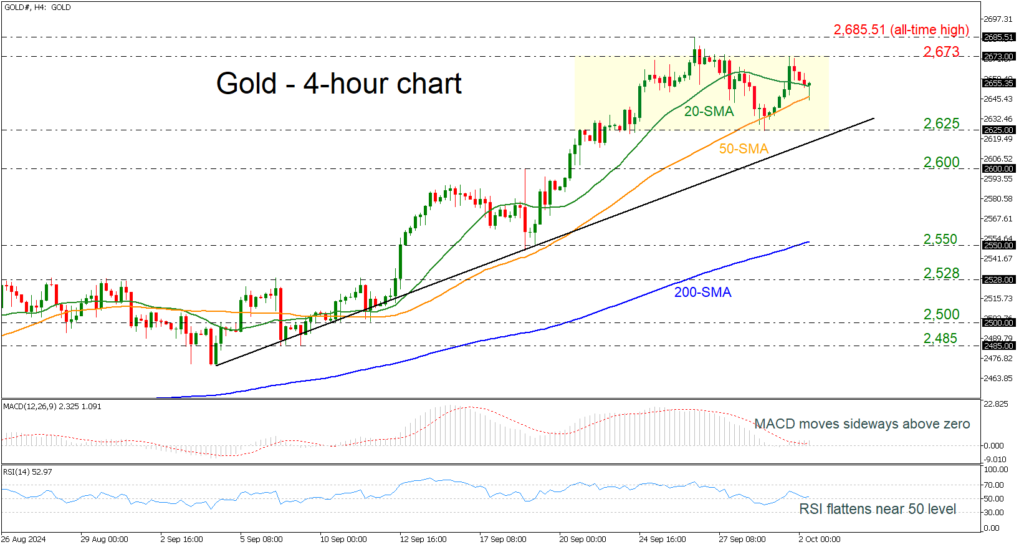

- Gold moves within 2,625-2,673

- Technical oscillators look flat

Gold prices have been moving sideways since the end of September, with the mid-level 50-period simple moving average (SMA) at 2,647. The price declined from the 2,673 resistance, but the broader outlook remains positive. The MACD and the RSI indicators are holding slightly above the zero and the 50 level, respectively, reflecting the latest horizontal move in the market.

If the price falls further, then immediate support could come from the 2,625 bar, ahead of the medium-term uptrend line at 2,612. Below that, the psychological number of 2,600 may pause the bearish move.

On the other hand, a climb beyond the 2,673 resistance could add some optimism for a retest of the record peak of 2,685.51. More advances may encourage the buying interest until the next round, a number of 2,700.

To sum up, the yellow metal is neutral in the very short-term view and needs some boost to continue the medium- and long-term bullish structure.

Source by: XM Global