- Gold’s pace moderates within triangle prior to Thursday’s CPI inflation data

- Technical signals favor the bears, but the trend may remain positive

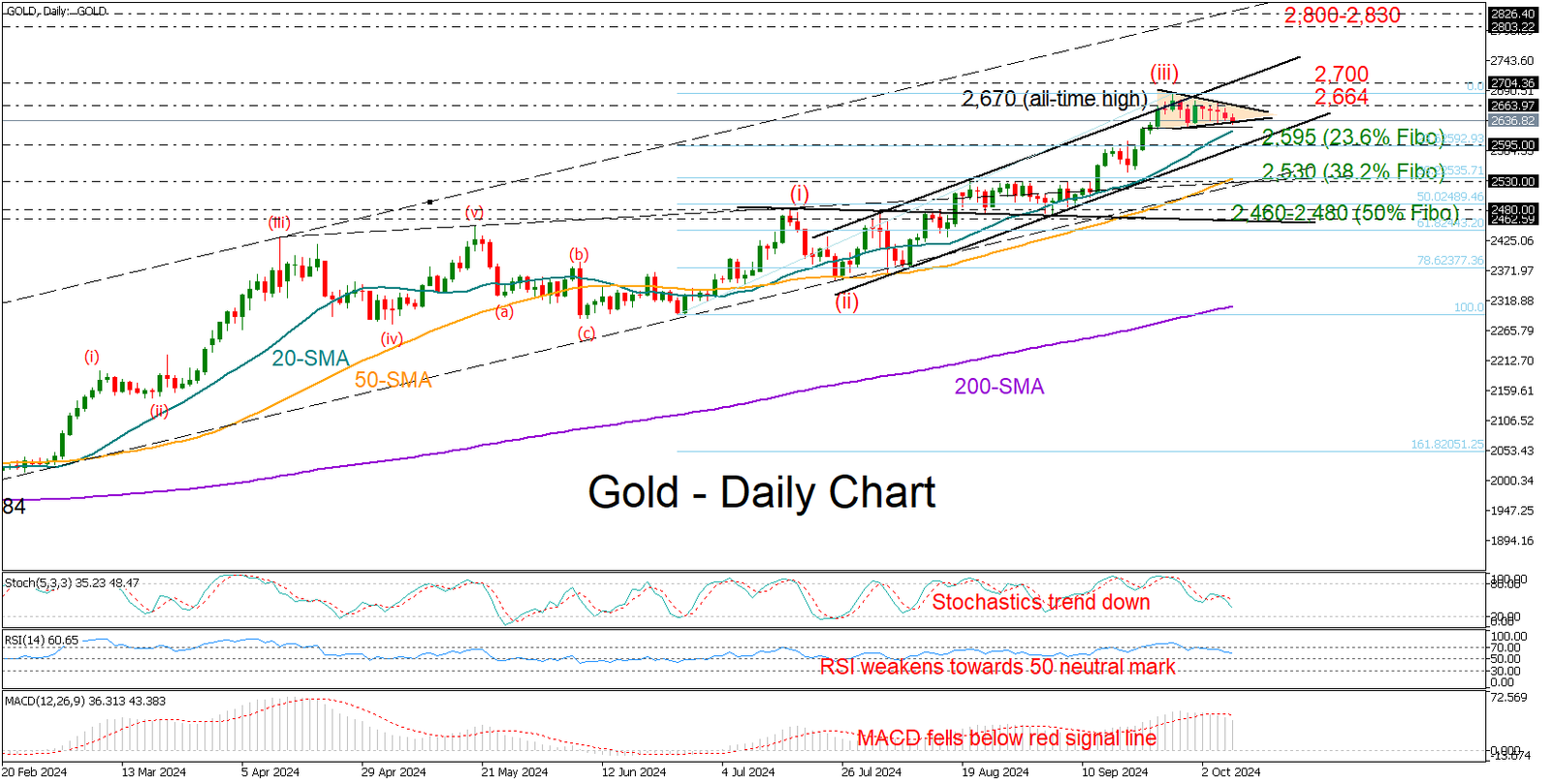

Gold held within the range of 2,624-2,670 despite the upbeat US jobs data last Friday, forming a symmetrical neutral triangle at the top of its broad uptrend.

Falling technical indicators suggest that buying sentiment is fading, leaving the precious metal vulnerable to downward movements in the upcoming sessions.

That said, traders are unlikely to be concerned unless the price dives below the lower band of the three-month-old bullish channel near 2,595. This overlaps with the 23.6% Fibonacci retracement of the 1-3 Elliot wave upward pattern. Therefore, should sellers violate that base, the price could sink towards its 50-day SMA and the long-term support trendline from February at 2,528. Even lower, the door might open for the 50% Fibonacci mark of 2,480 and the almost flat restrictive line at 2,460, a break of which would shift the medium-term outlook back to neutral.

Once the price surges above the triangle and the 2,664 level, the spotlight will immediately turn to the 2,700 psychological number and the channel’s resistance line. A successful penetration higher could last till the 2,800-2,830 region, where the ascending line that connects the highs from December 2023 and April 2024 is positioned.

Summing up, gold is expected to take a breather following its latest peak at an all-time high of 2,670. Any downside movements could be part of the ongoing positive trend.

Source by: XM Global