- Gold prices may post bearish correction

- Momentum oscillators lose steam

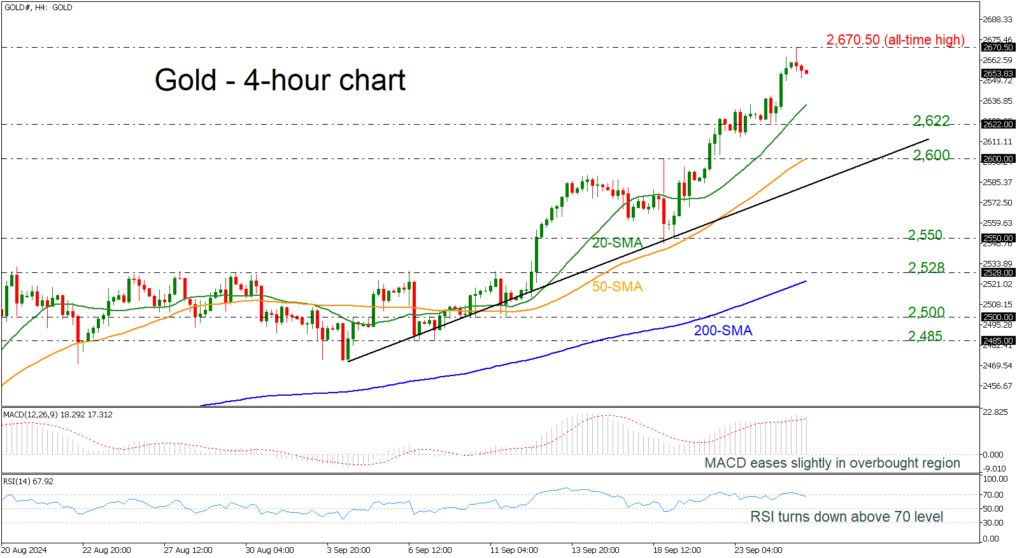

Gold prices are losing their strong positive momentum after flying to the 2,670.50 record high in the preceding couple of sessions. Moreover, the technical oscillators look overstretched. The MACD is easing above its trigger and zero lines, while the RSI is pointing down from the 70 level.

If the commodity ticks lower may move towards the 20-period simple moving average (SMA) at 2,630 ahead of the 2,622 support level. Below that, the significant 2,600 psychological mark may help the commodity to pause the downside move.

Alternatively, another boost to the upside may retest the all-time high of 2,670.50, while even higher the bulls may test the next round numbers such as 2,700 and 2,800.

Summarizing, the yellow metal has been in an aggressive buying interest well above the 2,600 key level despite the latest downside move in the 4-hour chart.

Source by: XM Global