- Gold looks for a bullish breakout above rectangle

- Bullish sentiment dominates; stability cannot be ruled out

- US CPI inflation figures due for release at 12:30 GMT

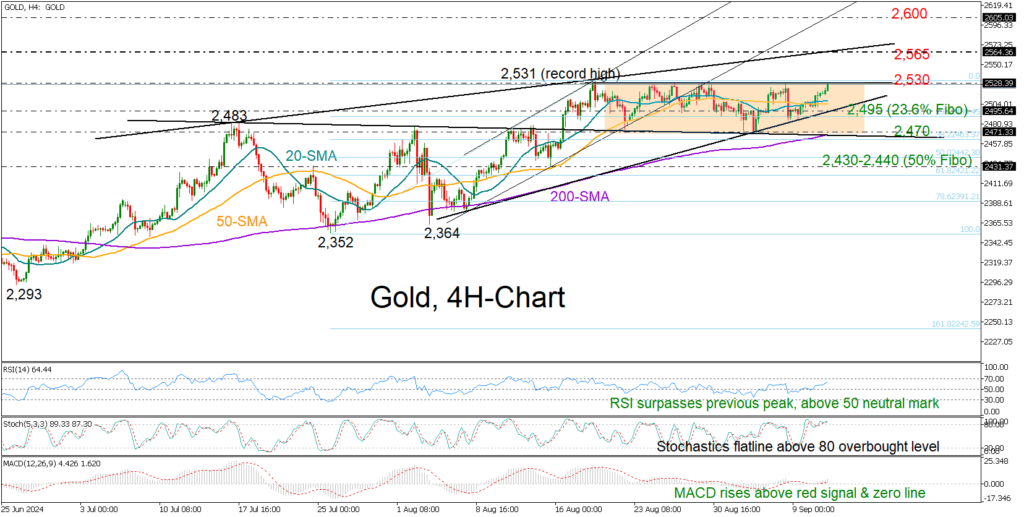

Gold rapidly approached the upper band of its three-week-old tight range at 2,530, increasing the possibility of entering unexplored territory.

The ball is still in the bulls’ court according to the technical indicators in the four-hour chart. The RSI is making a new higher high above its 50 neutral mark and the MACD is progressing within the positive area, though it’s near its previous peak, and the stochastic oscillator is fluctuating within the overbought region, keeping some scepticism in place.

Should the long-term uptrend resume above 2,530, the precious metal could ascend towards the resistance line at 2,565. Then, a decisive move higher could face a psychological test near the 2,600 level, a break of which could bring the 2,650 zone next into view.

In the event of a downside reversal, the 2,495 region, which encapsulates the 23.6% Fibonacci retracement of the July-August upleg, could act as support, preventing a drop towards the 200-day SMA and the lower band of the rectangle pattern at 2,470. The 38.2% Fibonacci mark is within this neighborhood. Therefore, a clear violation of this base might upset traders, forcing a rapid correction towards the 50% Fibonacci of 2,440 and the August 15 low of 2,332.

Overall, gold is trying once again to break free from its short-term horizontal path and reach new record highs, with the technical signals backing the current bullish attempt.

Source by: XM Global