- Gold surpasses previous top of 2,673

- MACD and RSI extend bullish structure

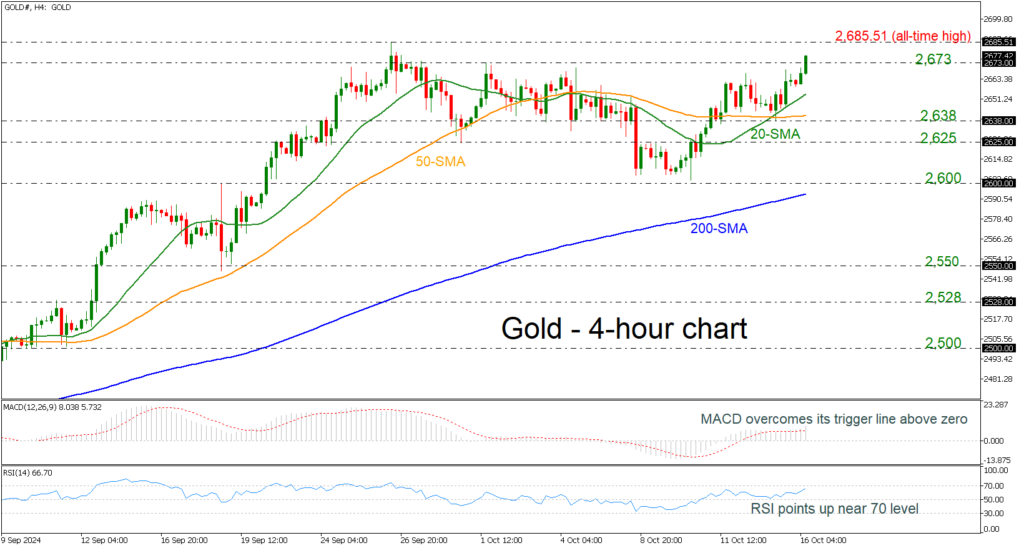

Gold prices are moving higher again today after bouncing off the 2,600 round number with the potential to hit the all-time high of 2,685.51.

In the meantime, the momentum indicators are supportive of this upleg. The RSI is moving higher, a tad below the 70 level. More importantly, the MACD oscillator has managed to edge above its trigger line while holding above the zero level.

Should the bulls still feel thirsty, they would try to overcome the record peak, testing uncharted levels such as the 2,700 and 2,800 round numbers.

On the other hand, the bears are probably keen on retaking market control and defending the 20- and 50-period simple moving averages (SMAs) at 2,652 and 2,641 respectively. The bears may then encounter the densely populated 2,625-2,638 region from the previous week. If traders manage to clear this area, they could then have the chance to test the 2,600 handle and the 200-period SMA at 2,593 in the 4-hour chart.

To sum up, gold bulls are trying to cancel out the neutral phase in the short-term view of the last month, but the path higher remains tricky.

Source by: XM Global