- NZDUSD hits fresh lows on US tariff threats

- Technical outlook remains gloomy

- RBNZ rate decision due on Wednesday at 01:00 GMT

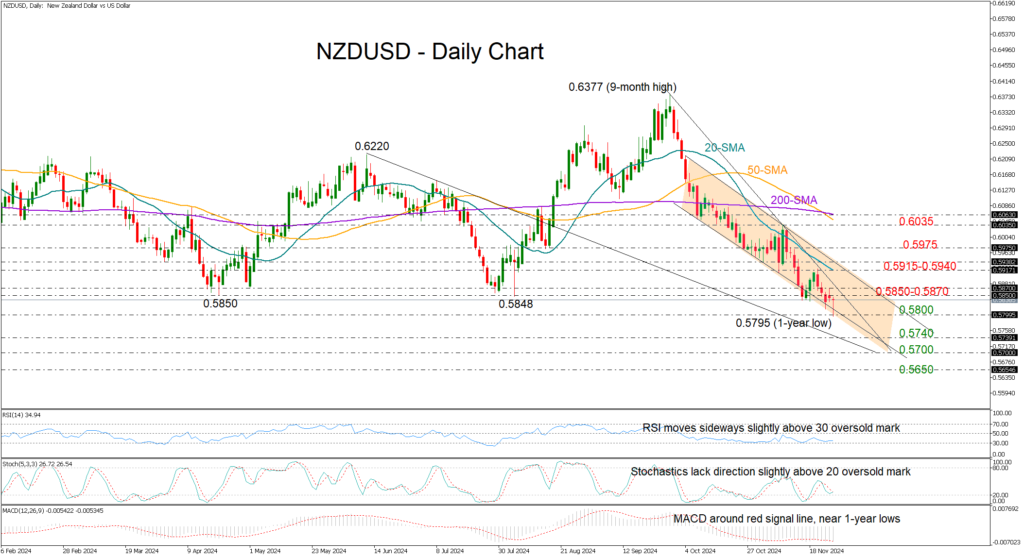

NZDUSD plunged to a one-year low of 0.5795 early on Tuesday following Trump’s renewed tariff warnings against Canada, Mexico, and China, but it soon managed to recoup its losses and return above the 0.5800 level.

The short-term outlook remains negative. The pair is trading below the 0.5850 support area for the second consecutive day, increasing the risk of further declines. While the RSI and stochastic indicators are near oversold levels, they keep moving sideways.

A close below the 0.5800 psychological mark, which triggered an impressive bull wave a year ago, could dampen market sentiment, squeezing the price toward the 0.5740 region taken from November 2022. If the 0.5700 round level proves fragile too, the decline could stretch toward the 0.5650 constraining zone last seen in October 2022.

Otherwise, an upside reversal could immediately halt near the steep resistance trendline at 0.5870. The 20-day simple moving average (SMA) at 0.5915 will be closely watched as well following the defeat near the line last month. Should the bulls surge higher, they may initially test the barrier of 0.5975 before advancing toward the previous high of 0.6035.

Overall, NZDUSD remains in a bearish trend, within a broad range that has held since the start of 2023. While short-term stability is possible, a significant rally seems unlikely. The Reserve Bank of New Zealand’s (RBNZ) rate decision on Wednesday could add further volatility, with a potential 50bps rate cut on the table.