- NZDUSD continues its sell-off

- Post-US election reaction dictates price action

- Momentum indicators have turned bearish

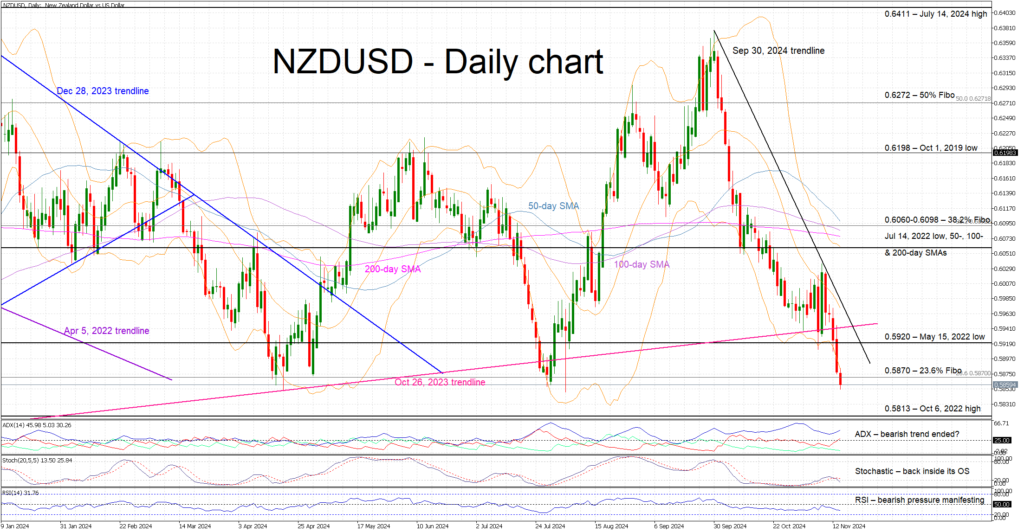

NZDUSD is edging lower again today, recording its fifth consecutive red candle, and keeping the bearish trend from the September 30, 2024 trendline intact. NZDUSD has easily broken below the key October 24, 2023 ascending trendline, and it is now trying to achieve a daily close below by the 0.5870 level. The latest move is the combined result of the US presidential election boosting the dollar, and increased expectations of an aggressive RBNZ rate cut weakening the kiwi.

Meanwhile, the momentum indicators have turned bearish. Specifically, the RSI has dropped above its 50-midpoint, indicating that bearish pressure is increasing. Similarly, the Average Directional Movement Index (ADX) is edging higher and hence confirming the current bearish trend. More importantly, the stochastic oscillator has returned inside its oversold area (OS). It may stay there for a while before showing an appetite for a decisive move higher.

If the bears remain confident, they could try to finally push NZDUSD below the 23.6% Fibonacci retracement of the April 5, 2022 – October 13, 2022 downtrend at 0.5870, and hence have the chance to record a new 2024 low. The door would then be open for a further selloff towards the October 6, 2022 high at 0.5813.

On the other hand, the bulls are anxiously trying to regain market control and keep NZDUSD above 0.5870. If successful, they could then push NZDUSD above both the May 15, 2022 low at 0.5920 and the October 26, 2023 trendline. Higher, the path looks clear until the busy 0.6060-0.6098 range, which is defined by the 38.2% Fibonacci retracement, the July 14, 2022 low, and the 50-, 100- and 200-day simple moving average (SMAs).

To sum up, NZDUSD bears are firmly in control and are potentially preparing for another selloff, if the post-US election euphoria lingers.