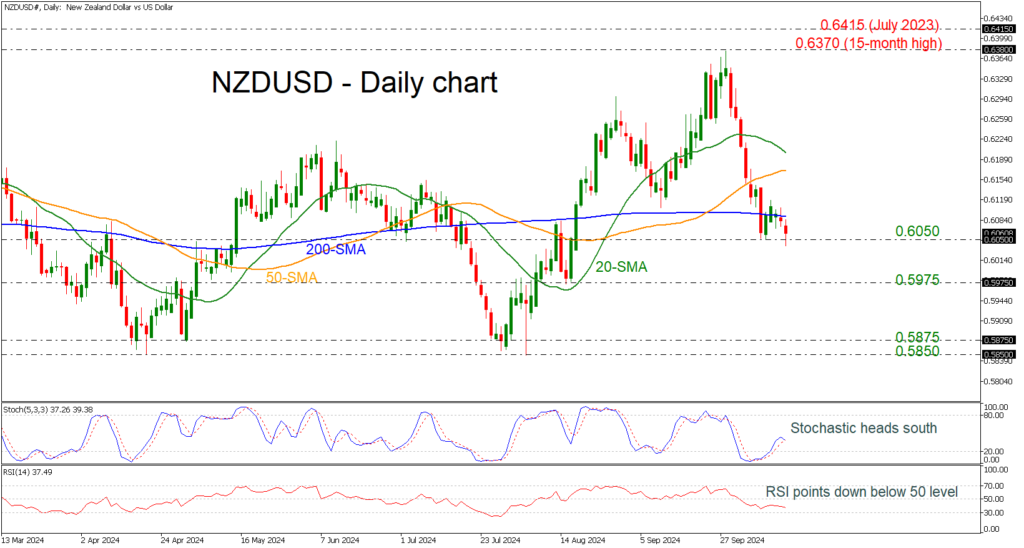

- NZDUSD hovers beneath 200-day SMA

- Stochastic and RSI maintain downside momentum

NZDUSD has found strong resistance near the 200-day simple moving average (SMA) at 0.6090, diving towards the previous bottom of 0.6050.

According to technical oscillators, they both confirm the recent bearish structure. The stochastic is heading south, ready to post a bearish crossover within its %K and %D lines, while the RSI is pointing slightly down below the neutral threshold of 50.

Diving further, the price could tumble until the 0.5975 support before testing the lows from August at 0.5875-0.5850.

Otherwise, an attempt above the 200-day SMA could send the bulls toward the 50- and then the 20-day SMA at 0.6170 and 0.6200, respectively. Rising above the SMAs, the price could find a real struggle near the 15-month peak of 0.6370.

All in all, NZDUSD has started a bearish wave in the preceding couple of weeks with the momentum oscillators suggesting more declines.

Source by: XM Global