- NZDUSD pulls back from its 15-month top

- Stochastic tumbles to oversold region

- RSI falls near 50 level

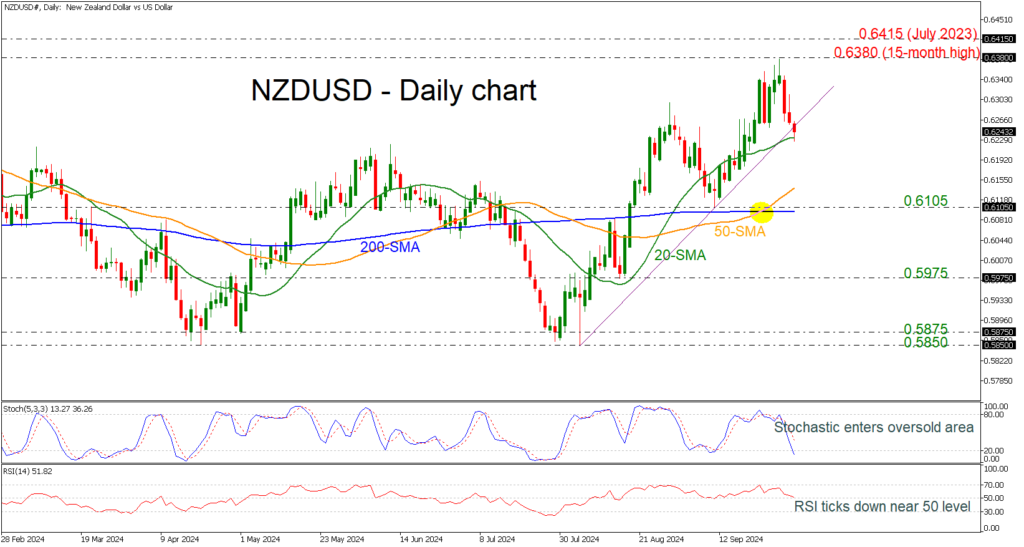

NZDUSD lost more than 2% following the pullback from the 15-month high of 0.6380, flirting with the short-term ascending trend line and the 20-day simple moving average (SMA).

In the previous days, the 50- and 200-day SMAs posted a bullish crossover, but the market is currently retreating, taking the technical oscillators lower. The stochastic dived towards the oversold region, while the RSI is trying to cross beneath the 50 level.

The 20-day SMA at 0.6230 could provide immediate support, ahead of the 50-day SMA at 0.6140. Below that, the 0.6105 bar may halt bearish action, which holds near the flat 200-day SMA.

On the flip side, if the market rises above the uptrend line, the next resistance could be the 15-month peak of 0.6380 and the July 2023 peak at 0.6415.

All in all, NZDUSD has been in a bearish correction over the last couple of days, but as long as it remains above the 200-day SMA, the broader outlook remains positive.

Source by: XM Global