- US 30 recoups losses but cannot resume uptrend

- Short-term bias is positive; confirmation awaited above 40,900

- FOMC meeting minutes due at 18:00 GMT

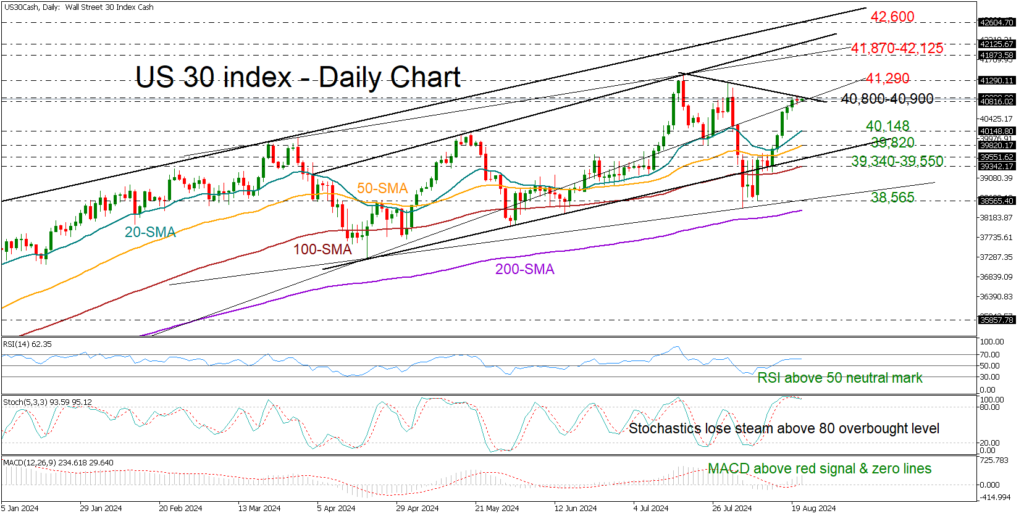

Following a downturn at the beginning of the month, the US 30 index (cash) has made a strong comeback, although it encountered obstacles in surpassing the 40,900 threshold on Tuesday.

The short-term resistance trendline that connects July’s highs is adding extra credence to the 40,900 regions, while the stochastic oscillator seems to be shifting downwards. Nevertheless, the RSI remains elevated within the bullish area above 50 and the MACD continues to strengthen above its red signal and zero lines, keeping the bias on the positive side, especially as long as the 40,800 floor holds.

If the price slips beneath 40,800, it could seek shelter near the 20-day exponential moving average (EMA) at 40,148. The 50-day EMA could also protect the market near 39,820 ahead of the support trendline at 39,550. Should the bears breach the 100-day EMA at 39,342 too, the index could experience a rapid downfall towards the August floor of 38,565.

In the bullish scenario the price crawls above the tough resistance of 40,900, the bulls might initially fight the 41,290 bar and then try to reach a new milestone near 41,870 or higher at 42,125. Beyond the latter, the uptrend could stretch towards the tentative resistance trendline from July 2023 at 42,600.

Summing up, the US 30 index is within a tight neutral zone, waiting for a close above 40,900 or below 40,800 to get a fresh direction.

Source by: XM Global