- USDCAD completes 8 green days

- MACD and RSI indicate strong positive momentum

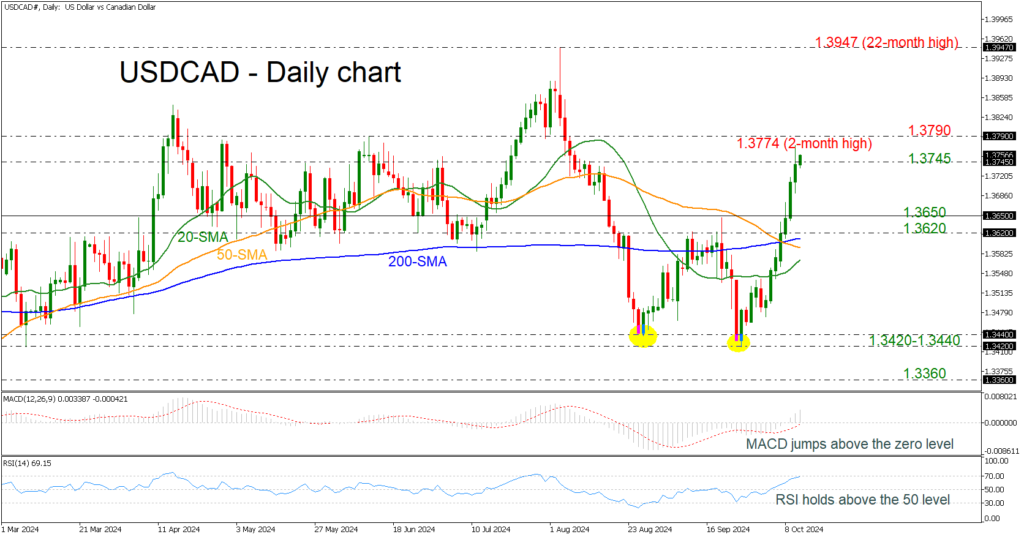

USDCAD skyrocketed to another fresh two-month high of 1.3774 during yesterday’s session, adding more than 2.5% following the rebound from the double bottom pattern around 1.3420. The aggressive buying activity above the 1.3650 barrier, which served as a neckline, completed the latest formation.

Currently, the price is experiencing its eighth straight green day, with the technical oscillators showing more room for improvement in the market. The MACD is extending its positive momentum above its trigger and zero lines, while the RSI is ready to cross above the 70 level.

More upside pressure could open the door for the next inside swing low of 1.3790 before challenging the 22-month high of 1.3947.

Alternatively, a potential pullback to the downside could meet support at the 1.3650 and 1.3620 support lines. Marginally lower, the 200- and 50-day simple moving averages (SMAs) around the 1.3600 round number may pause the decline.

In summary, USDCAD is forming a significant bullish retracement, with an extension above 1.3790, indicating potential for a robust positive structure in the short-term outlook.

Source by: XM Global