- USDCAD posts losses after 4½-year high

- RSI and stochastics confirm negative move

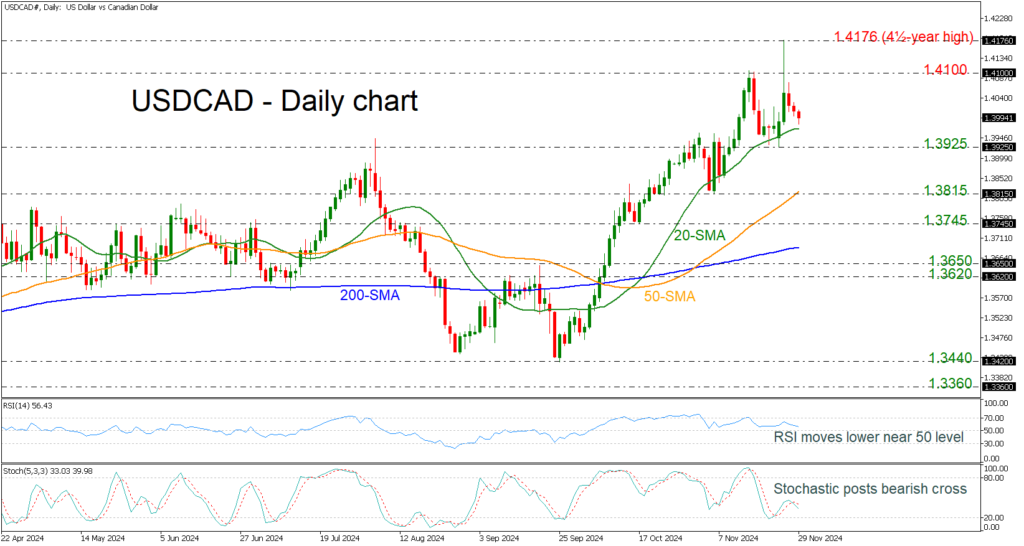

USDCAD is moving lower after the bullish spike to the fresh four-and-a-half-year high of 1.4176, falling beneath the 1.4000 round number.

The market remains in a positive territory; however, the technical oscillators are indicating further decreases. The RSI is pointing down slightly above the neutral threshold of 50, while the stochastic posted a bearish crossover within its %K and %D lines, heading towards the oversold area.

Immediate support could come from the 20-day simple moving average (SMA) at 1.3970 before testing the previous bottoms at 1.3925. A slide lower could open the door for a retest of the 50-day SMA at 1.3815.

Alternatively, a potential bounce off the 20-day SMA could send the bulls higher toward the 1.4100 round number and the multi-year high of 1.4176.

Summarizing, USDCAD has been in a bullish tendency since September 25 and only a decisive closing session below the 200-day SMA at 1.3690 may change this view.