- USDCAD is in green today after a strongly negative session on Thursday

- The 200-day SMA continues to act as strong resistance

- Momentum indicators question the recent bullish trend

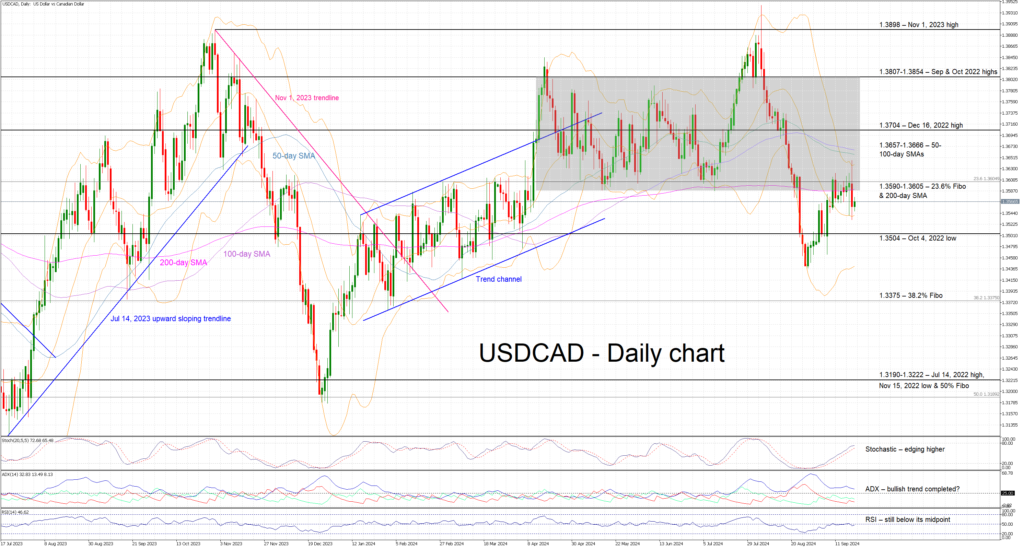

USDCAD is in the green today as dollar bulls are trying to react to yesterday’s weak performance from the greenback. USDCAD is hovering a tad below the 1.3590-1.3605 area and the lower boundary of the recent rectangle, as the 200-day simple moving average (SMA) is proving a rather strong resistance factor. In the meantime, the market’s focus is gradually turning to next week’s busy data calendar and the expected barrage of Fed speakers.

Momentum indicators are starting to question the recent bullish move. Specifically, the Average Directional Movement Index (ADX) is edging lower towards its midpoint and thus points to a weakening bullish trend. Similarly, the RSI remains below its midpoint, despite the recent upleg in USDCAD. Interestingly, the stochastic oscillator is trading sideways, a tad below its overbought area, and hence revealing a lower degree of bullish pressure.

Should the bulls remain confident, they could firstly try to finally overcome the busy 1.3590-1.3605 area, which is populated by the 23.6% Fibonacci retracement of the April 5, 2022 – October 13, 2022 uptrend and the 200-day SMA. If successful, they could stage a rally towards the 1.3657-1.3666 region where the 50- and 100-day SMAs currently reside. Even higher, the next target will probably be the December 16, 2022 high at 1.3704.

On the other hand, the bears could try to keep USDCAD below the 1.3590-1.3605 area, and gradually push it towards the October 4, 2022 low at 1.3504. They could then have the chance to break below the recent trough of 1.3438, and tentatively test the support set by the 38.2% Fibonacci retracement at 1.3375.

To sum up, with the market still digesting the Fed cut and preparing for another busy week, USDCAD bulls are trying to regain the upper hand and overcome a key resistance area.

Source by: XM Global