- USDCHF bounces back, dismisses bearish risks below 0.8800

- Bulls take control, aim for new higher highs

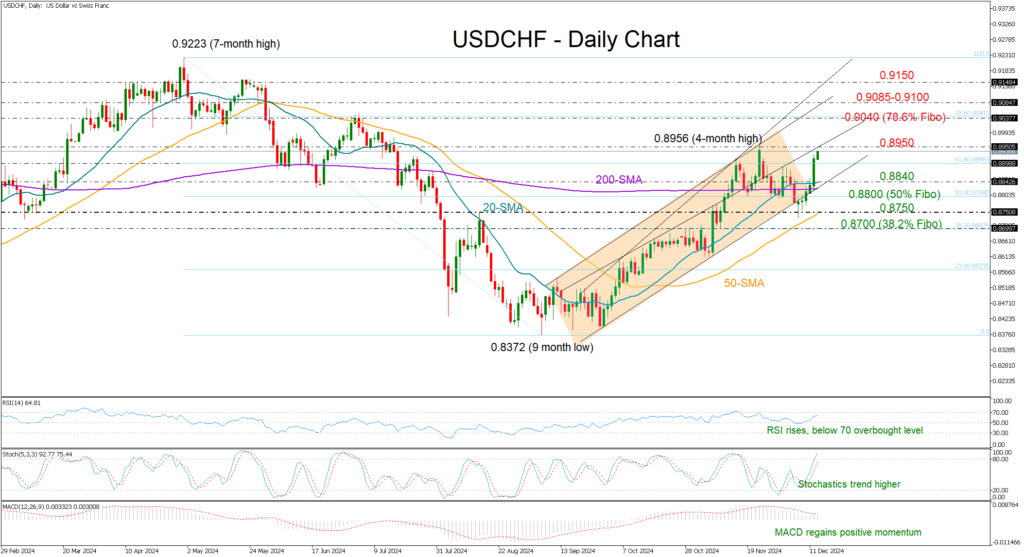

USDCHF staged an impressive rebound after falling as low as 0.8733, an action which initially seemed like the completion of a bearish head and shoulders pattern below the 200-day simple moving average and the 0.8800 number.

Now back in a bullish channel, the pair is willing to meet November’s high of 08956. There is more fuel in the tank according to the technical indicators as the RSI and the stochastic oscillator are rising and are still some distance below their overbought levels. Another encouraging sign is the bullish cross between the 20- and 200-day SMAs, which signals a trend continuation to the upside.

If the price were to close above the 0.8950 zone, the rally could gear up to the 0.9040 barrier, the 78.6% Fibonacci retracement of the previous downtrend. A victory there could provide fresh impetus toward the 0.9070-0.9100 constraining region, while a faster rally could reach the 0.9150 mark.

On the downside, sellers may wait for a slide below the 20-day SMA at 0.8840 before targeting the 50% Fibonacci of 0.8800. An extension lower could pause near the 50-day SMA at 0.8750 and if this cracks as well, putting the upward trend into question, there might be a quick decline toward the 38.2% Fibonacci of 0.8700.

In summary, USDCHF is bullish in the short-term picture and could mark new higher highs if the 0.8950 bar gives the green light.