- USDCHF trims latest rebound, holds bearish trend ahead of US data

- Short-term bias skewed to the downside; bears wait for a move below 0.8435

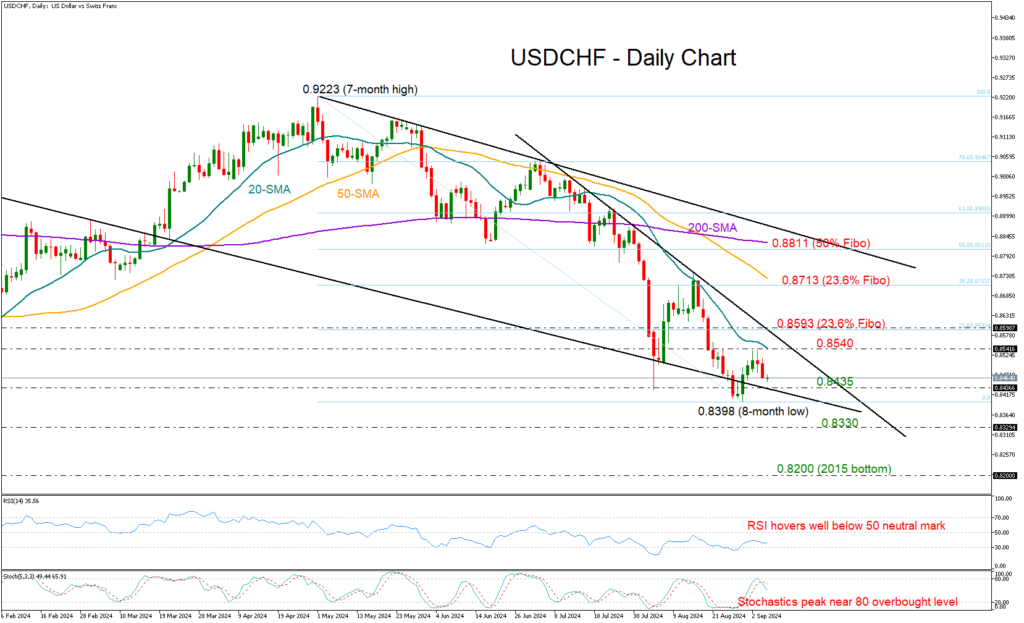

USDCHF has been stuck in a downward trend since April’s peak of 0.9223, unable to sustain any bullish corrections. More recently, following its bounce from an eight-month low of 0.8398, the price is once again subject to downward pressure.

With the RSI hovering well below its 50 neutral mark and the stochastic oscillator having peaked in the overbought zone, there is little hope for a meaningful rally.

A step below 0.8435 might re-examine the 0.8400 round level, which the bears could not successfully claim in August. If that base collapses this time, the price might next head for the December 2023 trough of 0.8330. A violation there could significantly worsen the broader outlook, opening the door for the 2015 bottom of 0.8200.

If the pair manages to drift higher, resistance could initially emerge between the 20-day simple moving average (SMA) and the 23.6% Fibonacci retracement of the April-August downtrend at 0.8593. A victory there could bolster buying appetite, lifting the price rapidly to the 38.2% Fibonacci number of 0.8713. Note that the 50-day SMA is within the neighborhood. Therefore, a breakthrough above it may result in a quick rally towards the 50% Fibonacci level of 0.8811 and the 200-day SMA.

Overall, USDCHF is in a bearish trend and could face additional losses if the 0.8435 region is breached.

Source by: XM Global