- USDCHF takes a breather after hitting a four-month high

- Buying the dip has an advantage above 0.8750

- US core PCE inflation eyed for more volatility later today

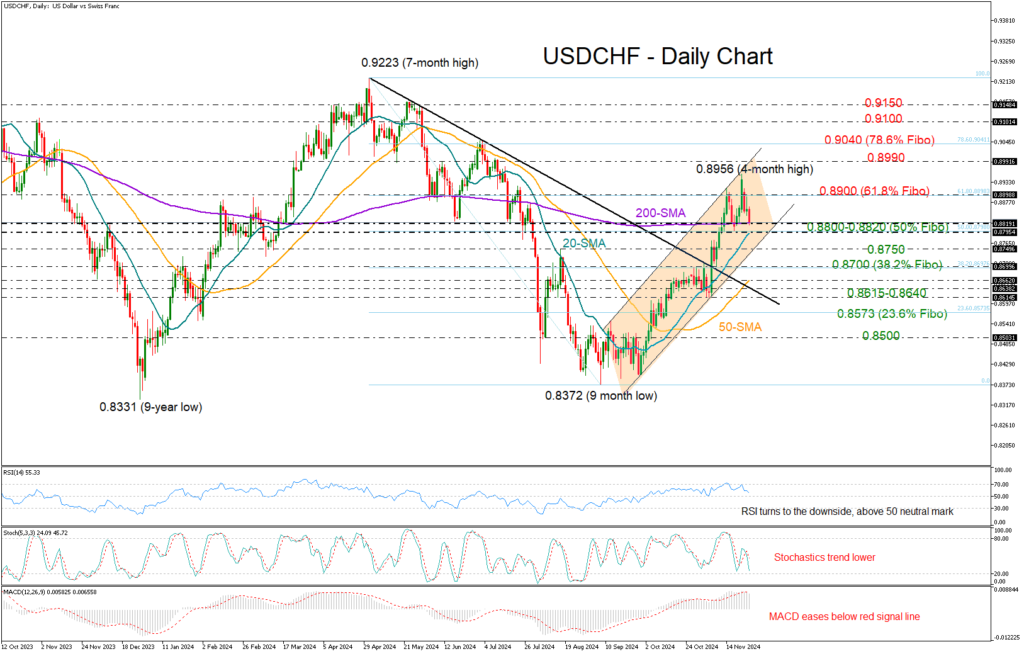

USDCHF lost momentum after its uptrend peaked at a four-month high of 0.8956 last Friday, and there could be more cloudy periods ahead according to the technical picture.

With the RSI changing trajectory to the downside after topping near its 70 overbought level and the MACD sliding below its red signal line, the risk is more on the downside than on the upside.

That said, the price continues to trade within an upward-sloping channel and the 20- and 200-day simple moving averages (SMAs), which could balance selling interest within the 0.8800-0.8820 region, are heading for a positive intersection. Hence, any potential declines could still be attractive, unless there is a negative correction beneath 0.8750.

In the event selling forces strengthen below 0.8750, the 38.2% Fibonacci retracement of the May-September upleg could take action around 0.8700 ahead of the 50-day SMA. Slightly lower, the 0.8615-0.8640 zone could force some stability, preventing a continuation toward the 23.6% Fibonacci of 0.8573. If the latter fails to hold, the downfall could reach the 0.8500 mark.

Should the bulls bounce back above 0.8900, they will aim for a test at the channel’s upper band near 0.8990. Success there could lead the pair toward the 78.6% Fibonacci level of 0.9040. Then, all the attention could turn to the 0.9100-0.9150 caution territory.

In summary, USDCHF could face some hurdles in the short-term, though it could stay attractive to buyers if it manages to rotate near 0.8750. Watch out for the US core PCE inflation data due today at 13:30 GMT.