- USDJPY loses ground around 200-day SMA

- RSI and MACD head south

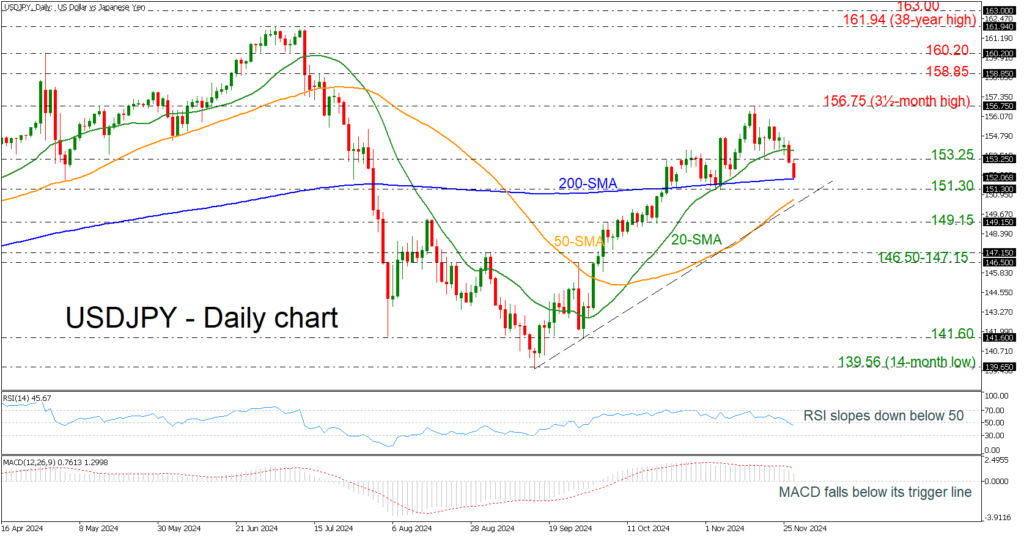

USDJPY has declined considerably toward the 200-day simple moving average (SMA) around 152.10, with the potential to hit the short-term uptrend line before heading upwards again.

The momentum oscillators are confirming the recent bearish movement. The RSI is pointing downwards, falling beneath the neutral threshold of 50, while the MACD is standing beneath its trigger line, losing some steam.

Further declines could see traders meeting the 151.30 support level, ahead of the 50-day SMA at 150.60. A tumble beneath these lines could endorse the bearish outlook, challenging the 149.15 barrier.

On the other hand, a pullback from either the 200-day SMA or the near-term rising trend line could lead the bulls towards the 153.25 resistance level. More increases could drive the market until the three-and-a-half-month high of 156.75.

To sum up, USDJPY is posting notable losses, but the outlook remains positive in the short-term view.