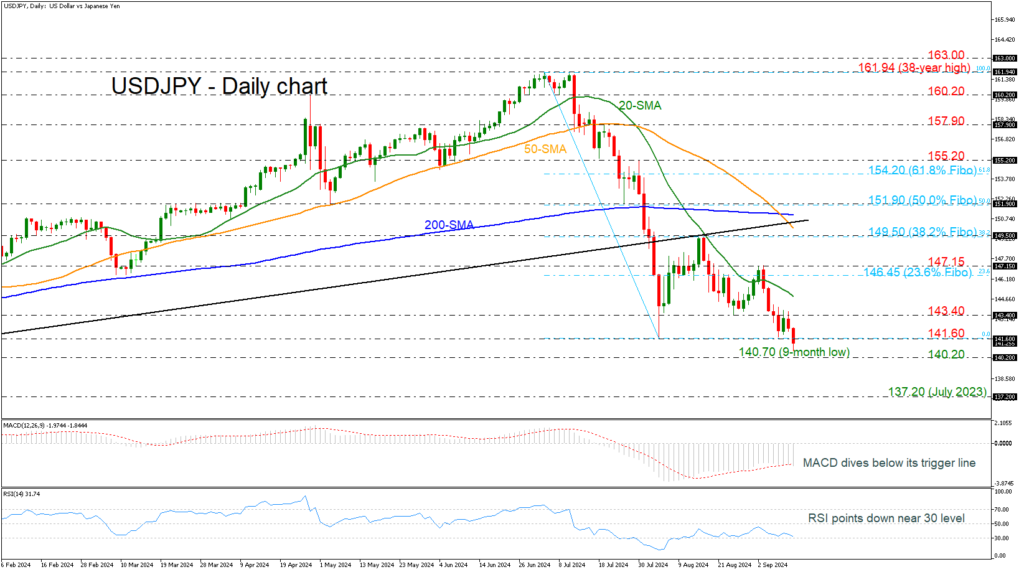

- USDJPY confirms the bearish structure

- Next support at 140.20

- Momentum oscillators keep moving negative

USDJPY tumbled to a fresh nine-month low of 140.70 earlier today, boosting the bearish structure that started at the beginning of July. If the market ends the day below the 141.60 strong barrier, then the focus will shift to the 140.20 support, taken from the lows in December 2023. Steeper declines could pave the way for a test of the July 2023 trough at 137.20.

On the other hand, a rebound from 141.60 could add some optimism about an upside correction, hitting the 143.40 resistance ahead of the 20-day SMA at 144.80. Rising further, the area within 146.45-147.15, which encapsulates the 23.6% Fibonacci retracement level of the downward wave from 161.94 to 141.60, may pause the upside move.

Technically, the MACD oscillator dives beneath its trigger line in the negative territory, while the RSI points down, approaching the oversold zone.

In summary, USDJPY plunged to a lower low today, indicating a bearish scenario. Only a decisive jump above the 200-day SMA at 151.00 may switch the outlook to neutral.

Source by: XM Global