- USDJPY jumps back into the 150 area after two months

- Caution needed due to overbought conditions

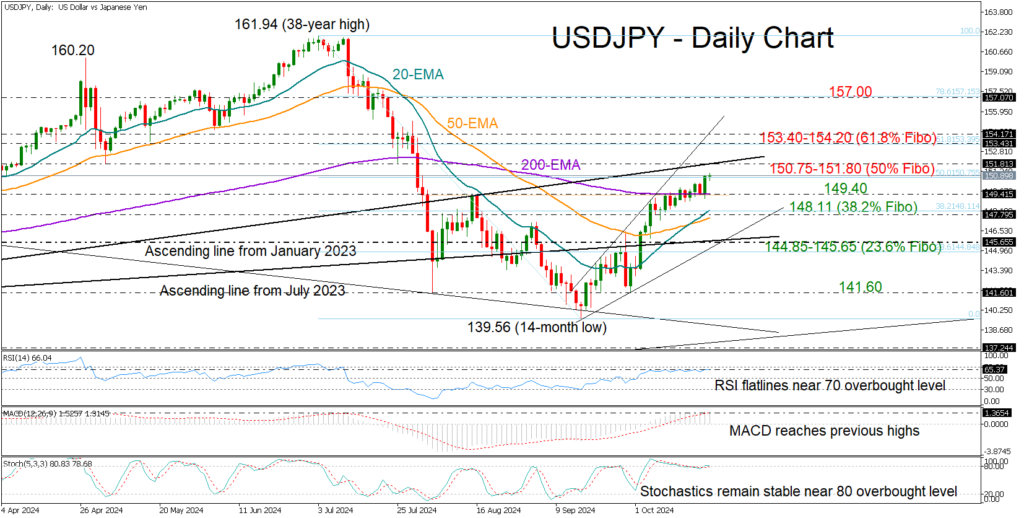

USDJPY kicked off the week on a strong note, rising at a faster pace to close above the 150.00 mark for the first time since August. The pickup in the price confirms a bullish breakout above the August high of 149.40 and the 200-day exponential moving average (EMA). Now, all eyes are on the important trendline, which has shifted from support to resistance, sitting at 151.80—this level previously led to a dip to a 14-month low.

That said, it’s worth noting that technical indicators are raising some red flags. The Relative Strength Index (RSI) and the stochastic oscillator are flatlining near their overbought levels. Note that the 50% Fibonacci retracement of the July-September downtrend is currently keeping the bulls in control around the 150.75 level.

In trend signals, the recent crossover between the 20-day and 50-day EMAs is instilling a sense of optimism, suggesting any pullbacks might be short-lived.

If buyers step in and push above the 151.80 resistance, the next area of resistance might develop between 153.40 and 154.20, which aligns with the 61.8% Fibonacci level. A sustained move higher could peak near the 157.00 level.

On the flip side, a pullback might initially retest the 200-day EMA at 149.40. If this base breaks this time, the 20-day and 50-day EMAs may come to the rescue near the 38.2% Fibonacci level at 148.11. Any further declines could lead the price toward the 144.85-145.65 range.

In summary, while USDJPY bulls have shown impressive strength lately, there are signs of exhaustion in the short term. A slight correction in the bullish trend seems likely before we see new higher highs.

Source by: XM Global