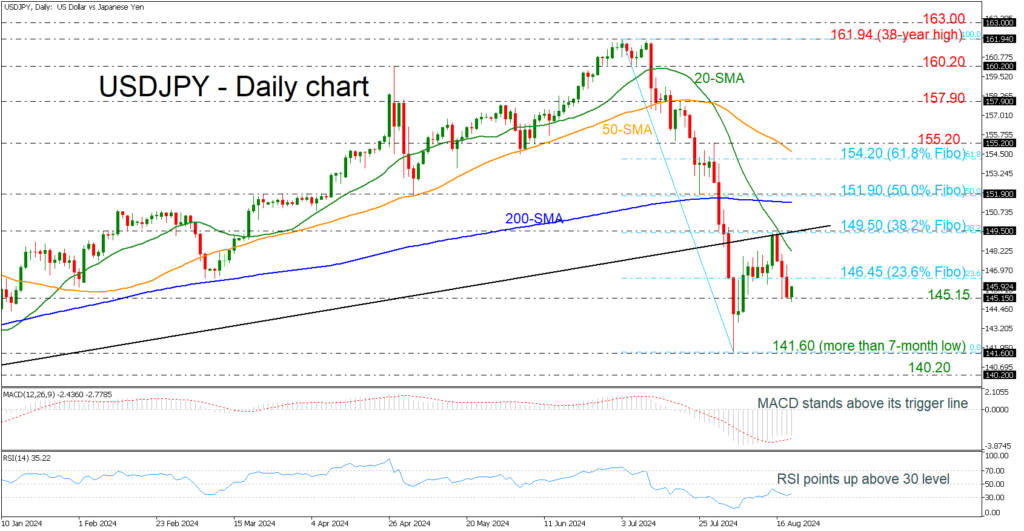

- USDJPY remains below the 200-day SMA and the uptrend line

- RSI ticks higher reflecting the latest move

USDJPY is gaining some ground after three consecutive red days and losing around 3% from the 149.50 resistance level. The market has been trading beneath the long-term ascending trend line since the downfall at the beginning of August and more importantly is holding below the 200-day simple moving average (SMA).

Switching to technical oscillators, the MACD is holding in the negative region but rose above its trigger line, while the RSI is pointing upwards, mirroring the latest upside move.

If the market overcomes the 23.6% Fibonacci retracement level of the down leg from 161.94 to 141.60 at 146.45 then may find first resistance at the 20-day SMA currently at 148.20 before challenging the previous peak at the 38.2% Fibonacci of 149.50.

Alternatively, a drop below the 145.15 immediate support could drive traders until the more-than-seven-month low of 141.60 and the 140.20 trough, achieved on December 28.

To summarise, USDJPY has been demonstrating a descending movement, especially after the break of the 200-day SMA, and only a climb above the 61.8% Fibonacci mark of 154.20 could change the outlook back to a positive one.

Source by: XM Global