- WTI crude oil weakens negative momentum

- Stochastic tries to head higher

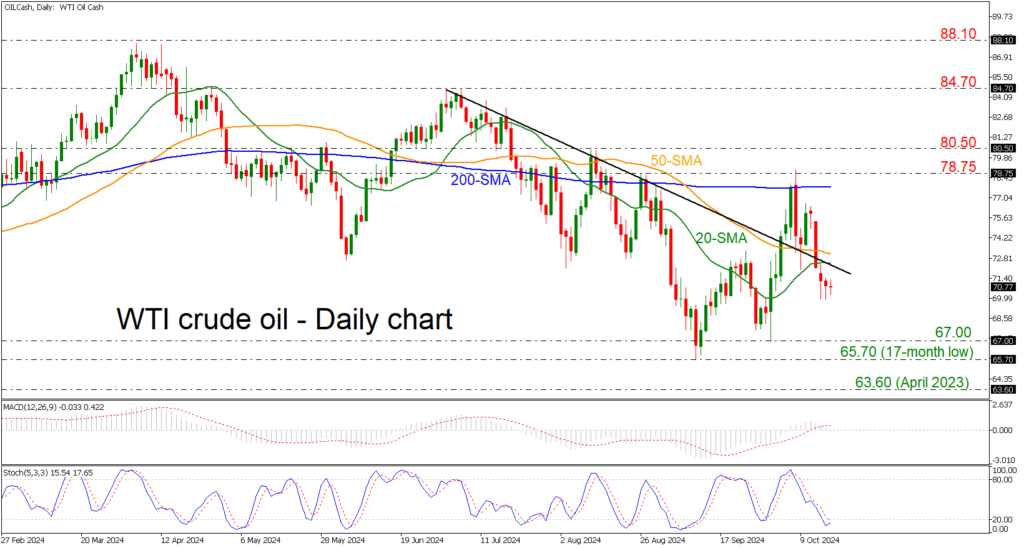

WTI crude oil futures continue to decline after encountering strong pushback at the 78.75 resistance and the 200-day simple moving average (SMA). The commodity returned beneath the short-term downtrend line, endorsing the bearish outlook.

The technical oscillators show some contradicting signs in the near term. The MACD holds beneath its trigger line with weak momentum, while the stochastic oscillator is ticking higher in the oversold territory, indicating the end of the bearish structure.

In case the market retreats further, immediate support could come from the 67.00 round number ahead of the 17-month low of 65.70. If the market continues to decline, it would confirm the bearish trend and post a lower low at the April 2023 trough of 63.60.

On the flip side, a jump above the short-term SMAs would send the market towards the 200-day SMA at 77.80 again, ahead of the previous top of 78.75. Even higher, the 80.50 barrier could come into focus, switching the bias to neutral.

In brief, oil prices are experiencing a negative movement in the short- and medium-term timeframes, and only an advance above the 80.50 resistance may change the current outlook.

Source by: XM Global