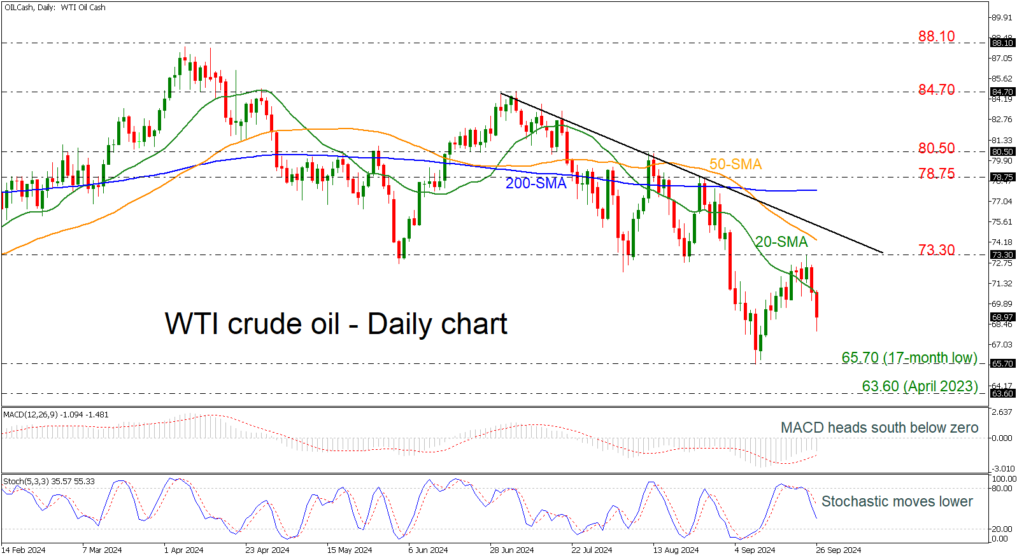

- WTI dives 7% from 73.30

- 200-day SMA moves horizontally

- MACD and stochastics confirm bearish outlook

WTI crude oil prices have lost more than 7% over the last couple of days after the pullback from the 73.30 resistance level. The commodity is also declining beneath the 20-day simple moving average (SMA) with the next support coming from the 17-month low of 65.70. Below that, the trough of April 2023 at 63.60 could be the next target.

On the flip side, a recoup of the latest losses could drive the market up to the 73.30 barrier ahead of the 50-day SMA at 74.30. A break above the short-term falling trend line could send the commodity towards the flat 200-day SMA at 77.75, switching the bias to neutral.

According to technical oscillators, the MACD is extending its negative momentum below the zero level, while the stochastic is diving from the 80 level.

In brief, oil prices have been creating a bearish tendency since the beginning of July and only a jump above the 84.70 resistance may change the current outlook to bullish.

Source by: XM Global