- WTI crude oil rebounds off 17-month low

- Technical oscillators are mixed

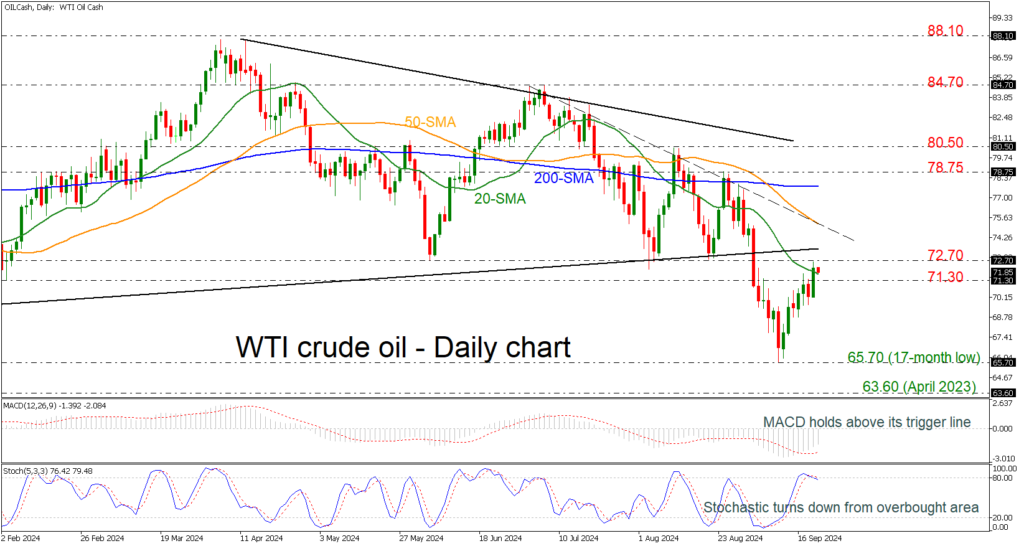

WTI crude oil prices have been creating a notable bullish correction after the significant bounce off the 17-month low of 65.70. Technically, the MACD oscillator is gaining some ground above its trigger line; however, the stochastic posted a bearish crossover within its %K and %D lines in the overbought region.

In case of more buying interest then the market may fight with the 72.70 resistance level ahead of the short-term descending trend line at 75.20, which overlaps with the 50-day simple moving average (SMA). Even higher, a strong obstacle could come from the 200-day SMA at 77.80.

On the flip side, a drop beneath the 71.30 support may drive the bears until the previous bottom of 65.70. Below that, the door could open for the April 2023 trough at 63.60.

All in all, WTI crude oil has been in a bearish tendency since it peaked at 84.70 on July and only a rally above the 200-day SMA may change the outlook to a more neutral one.

Source by: XM Global