- US CPI awaited as December Fed rate cut not a done deal

- Loonie at fresh lows ahead of expected BoC rate cut

- Aussie continues to bleed, yen see-saws on data, BoJ chatter

Spotlight on US inflation

There’s no change to the subdued market mood heading into the midweek but this could just be the calm before the storm as the economic agenda picks up a gear on Wednesday with the US CPI report and the Bank of Canada decision. If the aussie’s sharp reaction to the RBA’s dovish shift was a taste of what’s to come, markets may be in for a bumpy ride.

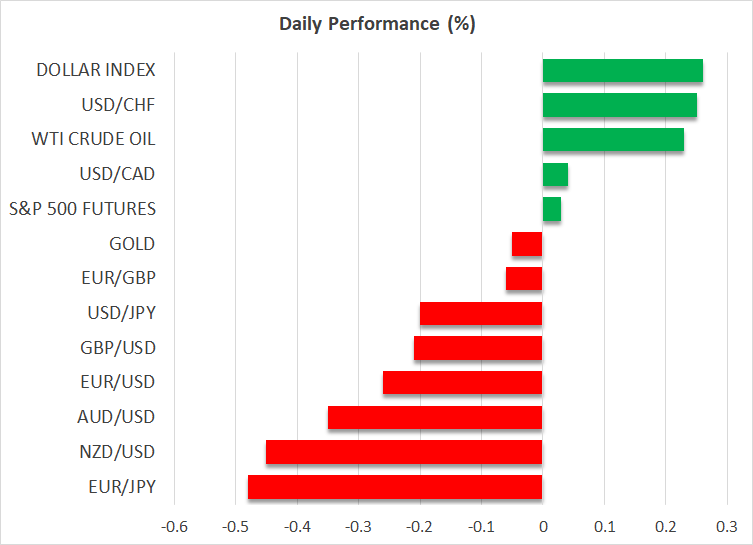

In the meantime, the US dollar is edging higher for a fourth straight day against a basket of currencies as its rivals struggle in the face of steeper rate cuts by their respective central banks than the Fed. This shines the spotlight even more so on today’s CPI numbers out of the US.

Although a 25-bps rate cut is about 85% priced in by investors, a much hotter-than-anticipated report could sway Fed policymakers to stay on hold in December, especially after Friday’s jobs data showed that the US labour market remains robust.

The annual rate of CPI is expected to inch up to 2.7%, with the core measure staying unchanged at 3.3%.

The risk to the dollar, though, is tilted to the upside, as even if the latest inflation readings reinforce bets of a December cut, there’ a good chance the Fed will signal a pause in January when it meets next week.

BoC set for another 50-bps cut

Investors’ focus is also on the Bank of Canada today, as Tiff Macklem & Co. are widely expected to slash rates by 50 basis points following the surprise jump in Canada’s unemployment rate in November. The Canadian dollar has already taken quite a tumble since Friday on the back of the jobs report, and with a larger cut more than 90% priced in, further losses could be limited.

The loonie brushed a four-and-half-year low of 1.4194 per US dollar yesterday. Whether the selloff will accelerate today will likely depend on the Bank of Canada flagging further aggressive easing in the coming months.

Aussie and euro struggle

The Australian dollar slid for a second day, hitting the lowest against the greenback in more than a year ahead of the November employment numbers on Thursday. It comes after the Reserve Bank of Australia’s policy decision on Tuesday that paved the way for a possible rate cut as early as February.

The European Central Bank is also meeting this week, and the euro is on the backfoot ahead of it. However, the euro’s pattern since late November is a sideways one as investors have scaled back bets of a bigger 50-bps move in December. If the ECB signals that it will stick with a gradual pace of 25 bps, this could be supportive for the euro in the short term as it battles political storms in both Germany and France.

The German Chancellor is expected to submit a formal application for a vote of confidence later on Wednesday, paving the way for snap elections in February.

Yen in a spin

The yen is having a bit of a rollercoaster session today, initially rising on strong wholesale inflation data but later diving on a Bloomberg report that the Bank of Japan doesn’t see any costs in taking its time to hike interest rates.

So whilst a rate hike is still in play next week, the odds are back to where they were at the start of the day, and the dollar is back in the 152.50 yen region for the first time in two weeks.